Remember how when we were children, money used to fly at the speed of light? We used to hold our pocket money in one hand while the other would spend it all relentlessly. Whether living off the bills given by parents or using the notes earned from a part-time job, learning how to manage your wallet is crucial. Otherwise, you will be left with zero savings for college expenditures. Or even worse, without practicing how to save, you’ll grow up without having a grip on this essential skill.

That said, I was the sort of teen who was given lessons on how to control my finances. My mother has always been an advocate of building savings. She has had a zero-tolerance policy for wasting bucks. Also, she’s a big supporter of earning yourself and having enough money to have your own back. In today’s article, I am sharing her tips with you. These simple tips can help live have a monetary policy in place that works in your favor.

Write down all your expenses and make a budget

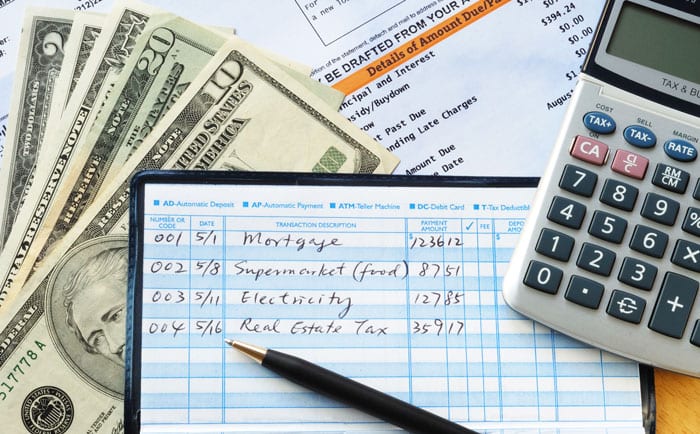

My mum has a journal set aside in which she writes all her expenses. She has embedded the same habit in me. While I am not one for writing my total expenses for the month down on paper, I use Microsoft Excel for keeping track of how much I am spending, where I am spending it, and where my savings stand at the end of the month.

It will be fruitful for you to write down a budget. Note down the amount you have to spend and that which you want to save. If you’re passionate about learning to save, the image of your set budget will limit you from spending more than you can.

Ruth Soukup from Living Well Spending Fewer advises the same thing. She says “Learn how to budget and save!”

Shop using coupons and from sales

Be wise with where you spend and how you do. My mum says that it is better to be smart with spending than purchasing an item that is in trend. She taught me this great tip: don’t go ahead and purchase an item when it drops immediately. The price is likely to go down after a while so wait before making your move.

Sales are offered around the year. You can shop using coupons as well. My mum used to gather coupons for apparel and accessories before going before buying our and her clothes. This way she saved good bucks on our clothing. You can find coupons from several couponing sites. The newspaper can also get you some printable coupons. This way you’d be able to buy what you want by spending less on it and saving more!

Save by cutting down expenditure on unnecessary items

Like I mentioned earlier, my mother is not a fan of money wastage. This is why while giving me full control of my money she still used to keep an eye on where I was spending my money when I first started getting an allowance. When I couldn’t get how to control my expenditures, she told me to cut down on the things I could live without.

This meant no excess shopping for apparel and makeup. It also meant no purchasing songs from iTunes as the radio could suffice. I also stopped purchasing movies and saved instead. I was taught to enjoy homemade meals and learned how to cook for my friends. This helped me save as I didn’t have to eat out a lot.

Whether you save for the future or for purchasing something big, useful, and expensive, it is a rewarding feeling. Catherine Alford, founder of BudgetBlonde advises, “Tell yourself ‘no’ as often as possible… This becomes such a habit that eventually you’ll see the savings pile up just because of that one little word.”

Start a savings account

Ask your parents to open a savings account for you. As a teenager, when I started saving money, my mind constantly wandered toward where I could spend it. My mum advised me to keep it somewhere where I wouldn’t be tempted to take it from. But I was adamant about keeping it in my wallet where I could see it.

She then brought the idea of a savings account forward. Naturally, I was intrigued by the idea of having my own bank account. Opening a savings account didn’t only give me an insight into banking and keep my money safe. It also increased my money without me having to do anything owing to interest. It’s a win-win situation.

Don’t overuse your credit or debit cards

I’ll be honest with you; my mum didn’t even hand a card to me until I didn’t learn to be responsible with my spending habits. You see, when you pay with a credit or debit card, you are likely to overspend. The source of money seems to be endless and spending a little more doesn’t feel bad. It’s all good until you are under the burden of debt.

On the other hand, you are more likely to be mindful of your expenditure when you pay with cash. Chairman and CEO of North Jersey Community Bank, Frank Sorrentino III, said while stressing on the convenience that a debit card comes with, “Part of the reason we’re having the problems we have today is that it’s too easy for people to buy things that they can’t afford.”

He then went on to explain how he was in the favor of an America Express Charge Card and recommended it to his son when turned 18. Such a card requires the balance spent to be paid on a monthly basis.

To wrap up, learn how to save before it is too late. You see, saving money is a helpful habit that needs to be built. You can start by making a budget and spending only where necessary. Then ask your parent for a savings account. Shop from sales and using coupons. And above all, avoid debit cards; they can be sinister.