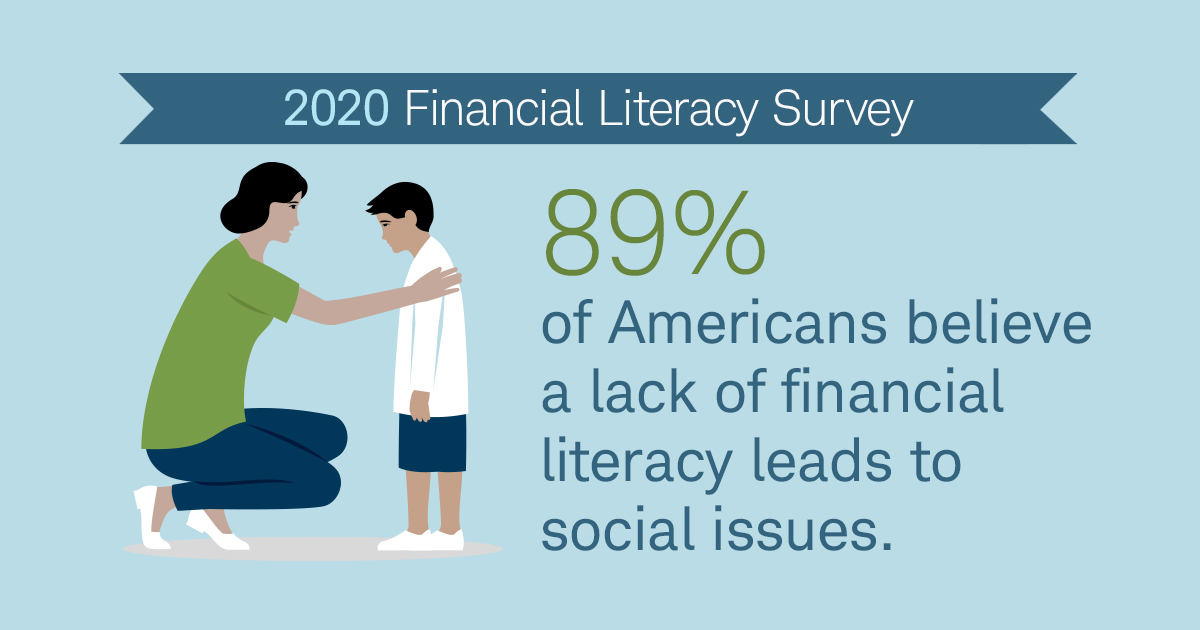

At a time of social unrest and deep divisions in our country, consensus can be hard to find. But one thing that nearly everyone in this country agrees on is the devastating impact that lack of financial literacy has on our citizens. Many of the social issues tearing at the fabric of our country can be connected in some way to low levels of financial literacy. According to a recent Charles Schwab Financial Literacy Survey, 89% of Americans agree that lack of financial education contributes to some of the biggest social issues our country faces, including poverty (58%), lack of job opportunities (53%), unemployment (53%), and wealth inequality (52%).

Financial illiteracy is insidious and shows up in ways that aren’t always obvious. For example, many employers check the credit reports of job applicants. That means that someone who may have made a poor financial decision in the past could be overlooked for future job opportunities.

The global pandemic has compounded this large and complex social justice issue, disrupting every aspect of life, including how we spend our money. COVID-19 began as a health crisis but quickly became an economic crisis, too, exposing just how financially vulnerable most Americans are.

This pandemic has been a wake-up call for a lot of people, especially those who live paycheck-to-paycheck. Half (50%) of all Americans would experience financial hardship if they had to cover an emergency expense of $1,000 or less in the next 30 days, according to our research. Think about that: half of our country is teetering on the edge of financial despair.

So it’s no surprise that most people wish they had better personal finance skills. When asked what they would teach their younger selves based on what they know today, Americans said the value of saving money (59%), basic money management (52%), and how to set financial goals and work toward them (51%).

Financial literacy is a life skill that everyone needs. In my work with Charles Schwab Foundation, I have seen first-hand the lifelong benefits that financial education can have. For example, kids who complete the personal finance course Money Matters offered through Boys and Girls Clubs of America learn about financial aid and how to complete the FAFSA, making them more likely to attend college, which improves their chances for economic mobility.

Our survey, conducted in June by The Harris Poll among a sample of over 2,000 U.S. adults, shows that Americans want to prioritize financial education for future generations. In fact, even while we’re in the middle of a global health crisis, Americans would still prioritize financial education over health and wellness education as a supplementary graduation requirement to math, English, and science (63% vs. 43%, respectively).

Americans were also asked to rank on a scale of 1-100 the most important skills for kids today to learn. At the top of the list was responsible money management (62.9), followed by the dangers of drugs and

alcohol (60.5), healthy eating and exercise habits (58.3), and safe driving practices (57).

We’re at an inflection point right now. Society is debating when and how to reopen schools, the trade-offs between virtual and in-person learning, and how to social distance in classrooms. As we rethink how we teach our children, let’s pause to also think about what we teach them.

The fact is, financial education can improve people’s lives by giving them the money management skills they need to feel confident about their future. I have always believed that financial literacy can be the great equalizer to many of the social issues we face. Americans today, and future generations, are depending on schools to teach them the skills they need to be successful in life, including how to manage their money. Almost two-thirds (65%) of Americans said that outside of family, schools should play a

primary role in providing financial education, followed by government (12%) and employers (10%).

But only 21 states currently require high school students to complete a personal finance course. That number should be 50, because all Americans deserve the opportunity to achieve financial security.

About the Survey

The Charles Schwab Financial Literacy survey was conducted online within the United States by The Harris Poll on behalf of Charles Schwab from June 4-8, 2020 among 2,046 U.S. adults ages 18 and older. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated.

0820-04XA