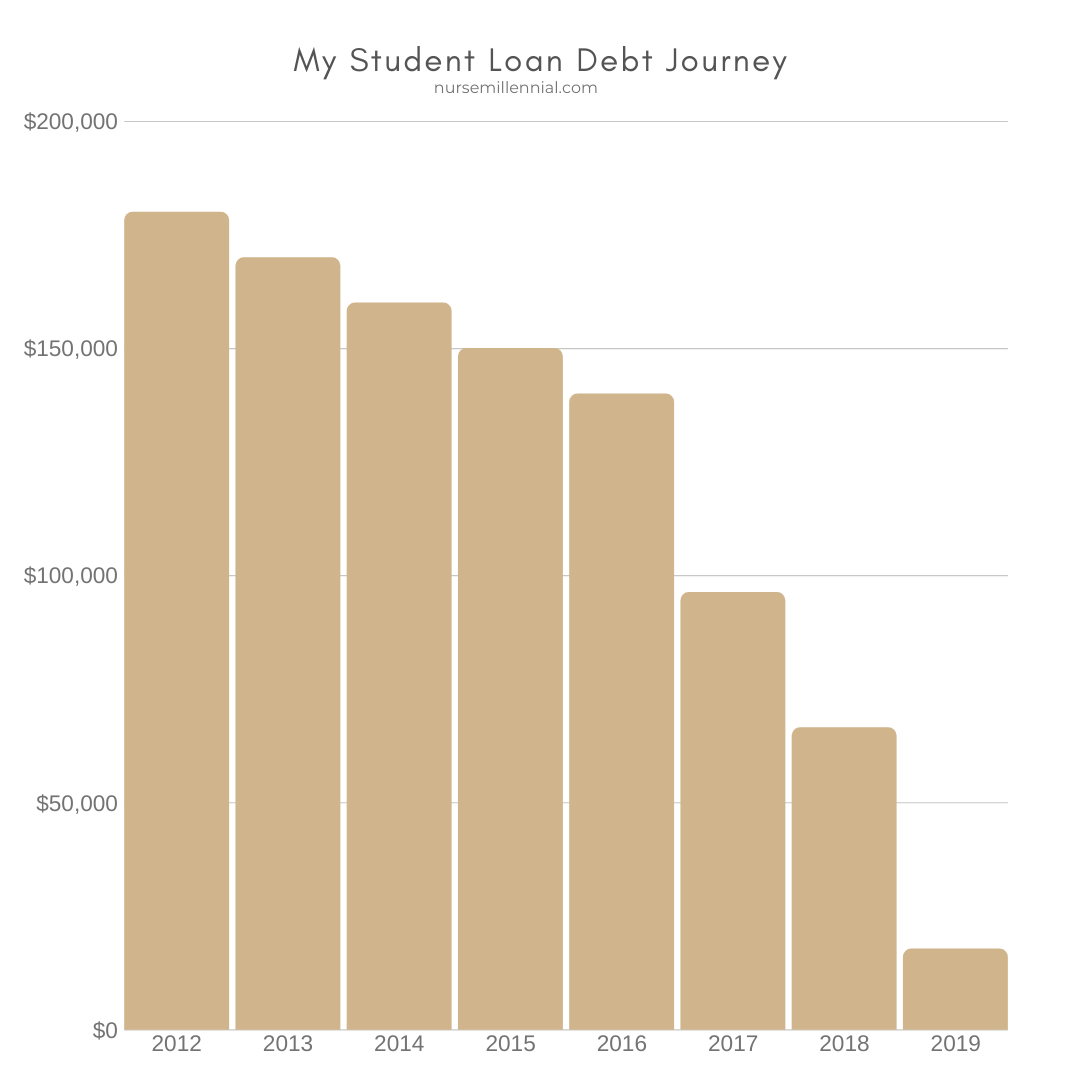

My journey to paying off $162,203.17 in student loan debt in 7 years has been quite a ride. Below is a visual of the debt repayment by year.

As it is said, “Rome wasn’t built in a day.” This process wasn’t jump started until I encountered a dramatic mindset change like that of a protagonist in a movie. Here’s the synopsis.

Enter Protagonist

As a new grad nurse in 2012, my focus was to pass the NCLEX, start my career, and live life how I thought adults were supposed to.

“You have no man, no net worth, but you have integrity.” -Awkwafina, Crazy Rich Asians.

I had $180,000 in student loan debt, a few hundred dollars in savings, and a balance on my credit card. My net worth was roughly around –$182,000. Calculate your net worth using this worksheet here.

Getting my financial life together wasn’t included in my definition of “adulting.” Going out and experiencing new things were at the top of my priorities.

I spent money like I had it, paying off only $40,000 in the first 4 years. Read about how much FOMO cost me here. The amount I spent in FOMO tickets alone, $3,489, only could have covered less than half of the interest I paid to student loan debt each year.

I saved a little here and there, but because I followed no budget and frequently used my credit card, I constantly dipped into that savings account. Similar to my dog Leo who struggles every time he chases his tail.

Enter Antagonist: Student Loan Debt

“Oh you graduated?” – Sallie Mae, getting ready to hit you with a bill when that 6 month grace period ends.

Every month I took from my checking account $1,536.15 to pay my loans. I had loans with 4 lenders (Fedloan, Heartland ECSI, Sallie Mae, and Wells Fargo) spread across 19+ loan accounts. Imagine the overwhelm I felt trying to make sense of it all!

Looking back, I feel embarrassment and absolute terror for my financially naive 24 year old self. It makes my heart feel so heavy that it weighs into my stomach. Disgust.

I was barely learning how to be a nurse and had no idea what it was to be financially stable. Throughout this journey I constantly ask why did I do this to myself?

In an attempt to organize my loans and decrease my interest rate I consolidated and refinanced. Read about how I consolidated and refinanced my loans here.

Stage left: Quarter-Life Crisis

A few years went by and there came a certain point when I hit a figurative wall, which was my Quarter-Life Crisis. Read about it here.

In short, I struggled with balancing my time between taking care of my dad, adjusting to caregiver burnout as a nurse, the future I wanted to create for myself, and establishing financial independence with a burdensome amount of student loan debt.

I knew that if there came a day where I needed to either work less to take over primary care for my dad or work more to financially support my future family, I wouldn’t be able to pay off debt effectively.

My inner turmoil pleaded with me to do something different. I wanted to be able to provide for others without worrying about putting myself further into debt.

7 years of Character Development

After starting yet another per diem job I had enough of the tail chasing. I googled “how to get out of debt” and came across an inordinate amount of information.

Listed here are a few methods I used to guide myself financially (there are more on the blog so please check them out):

- Dave Ramsey’s Baby Steps (I didn’t follow this perfectly)

- Debt Snowball

- Zero-Based Budgeting

- Cutting out unnecessary expenses

- Practicing frugality

- Utilizing the dollar stores

- Increased my income (obtained a certification in my specialty, put all extra money earned from per diem work, overtime, and holiday pay toward debt)

Throughout my debt payoff journey I’ve changed my attitude toward money. I’ve realized something all in all: you are the only one who can get you out of debt.

Of course there are obstacles in our way, read about the 6 barriers that kept me in debt here. Everyone will come across some sort of debt and each with unique personal and financial situations; one size does not fit all.

Each journey is unique, don’t compare your journey or story with someone else’s. So long as you know that you’re working toward your own goal and doing what works for you, you’re golden.

Something interesting that happened as I paid off the majority of my debt: an increase in self confidence. Debt and self confidence have an inverse relationship. Slowly my inner turmoil began to solve itself and my vision of the future became clear.

Epilogue

Cut scene to 2019; my loan is down to $17,796.83, which is 90% paid off! Paying the majority of my debt also increased my net worth. Now that debt payoff is so much closer I’m getting even more antsy. 2020 is when I become debt free, y’all!

I took the shitty financial situation I put myself in and flipped it to create a reality closer toward my goal of financial stability and financial independence. I’m able to look back and say yeah, I did that!

Millennial Challenge

- How far have you come in your debt payoff journey?