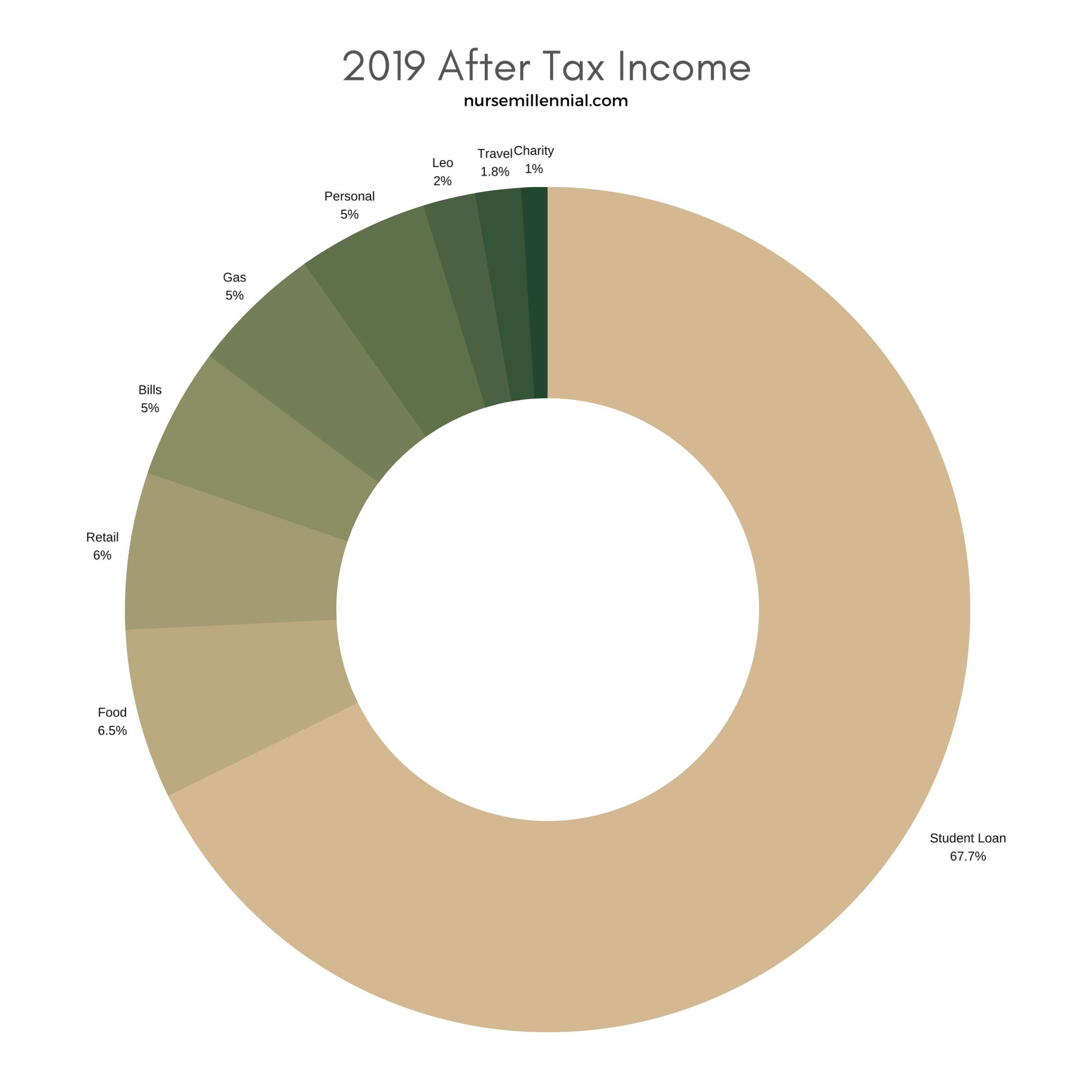

I took a deep dive for my 2019 Year in Review to take a look at the specific financial habits that helped me throw 67.7% of my income to student loan debt.

One of my favorite Warren Buffet quotes:

Don’t save what is left after spending. Spend what is left after saving.

My priority right now obviously, as I’ve been repeatedly reminding myself, is to pay off student loan debt.

This quote is more appropriate to me by rephrasing to “Don’t pay debt with what is left after spending. Spend what is left after paying debt.

Utilizing my Budget Book, I was able to properly analyze every transaction made last year. Read about how I use this here.

Average # of No Spend Days (NSDs) per month = 9.5 days

No Spend Day = a day when I do not spend money.

- Lowest # of NSDs in one month = 6

- Highest # of NSDs in one month = 14

Average # of Debt payments per month = 3

- Lowest # of debt payments in one month = 2

- Highest # of debt payments in one month = 6

I’ve summarized categories in approximate percentage of my annual after tax income.

Debt = 67.7%

- Lowest monthly % of income to Debt = 11%

- Last February I was still intent on saving money, I saved more money than I transferred to my student loan.

- Highest monthly % of income to Debt = 75%

- Lowest monthly Debt payment = $643.02

- Highest monthly Debt payment = $14,828.98

- Highest Debt payment in 1 transaction = $9,757.07

- This payment was not from income, I emptied my savings account in May out of remorse for trying to save money and pay debt aggressively. No regrets!

- The only savings I’ve had thereafter is a $1,000 emergency fund. Read about Dave Ramsey’s Baby Steps here.

- Lowest Debt payment in 1 transaction = $3.60

- Last September I sold a Coachella sweater to Buffalo Exchange for $3.60, then transferred this amount to my student loan.

- Speaking of Coachella, find out how much going to festivals cost me here.

Food = 6.5%

- Average % of Food expenses to Coffee = 8.24%

- Average % of Total Income to Coffee = 0.3%

- Average $ to Coffee per month = $21.25

I was able to keep food expenses low by bringing food to work each day, eating at home on weekdays, and budgeting for dinners out with friends.

My Fiance has paid for the majority of our dates! (Thanks, Bae <3)

Retail = 6%

This includes shopping on Amazon, wardrobe, and expenses when going out.

Having a frugal lifestyle helps keep my expenses down. Read 15 ways to be frugal here.

I’ve also cut out a lot from my budget. Find out what I don’t spend money on here.

Bills = 5%

The only bills I have besides student loan debt: phone bill, car registration, and car insurance.

Unpopular opinion: my biggest help in keeping expenses low is living at home.

Gas = 5%

Average $ to gas per month = $249.48

Personal = 5%

This includes hair cuts, getting facials and nails done for special occasions, gym membership, and also expenses related to my Nursing license such as license renewal fees, CEs, conferences, etc.

Leo = 2%

I complain a lot about Leo’s expenses (hair cuts, vet visits, eye medication, etc.), but looking at it now it’s actually manageable.

Travel = 1.8%

Last year we traveled to Mexico with our friends. I used to feel guilty about going on vacation while paying off my student loan, but considering it’s only a small percentage of my income I don’t feel as bad.

Included in this total are Uber and Lyft rides to and from home during our local nights out.

Charity = 1%

When I’m out of debt I’d like to increase this number and give regularly.

One of the charities I give to is run by a few of my favorite gals, Isabela and Jessica. Check out LA Heroines here.

In Summary

50% of my after tax income went straight to debt. I’m hoping to decrease money spent in Retail and increase money given to Charity.

Besides income, having minimal expense is the key to being able to free up money. My financial habits and sacrifice in lifestyle brought me a long way.

I’m Grateful

I feel extremely thankful to have the ability to work, continue to learn, have a stable job, live at home, and have the blessings that God has graced me with in order to get to where I am in my life today!

Not to mention I have the best fiance, family, and friends, who’ve been extremely understanding and supportive throughout my journey to be debt free!

Millennial Challenge

- What can you do in your budget to free up some cash?