Some time ago, I participated in a couple of sessions focused on pensions and interestingly took note of the large number of younger colleagues asking questions that themed on accessing some of their long-term savings with a view to making it work for them in other ways. The low risk appetite was not a surprise given the age demographics. In fact, I was quite enthused.

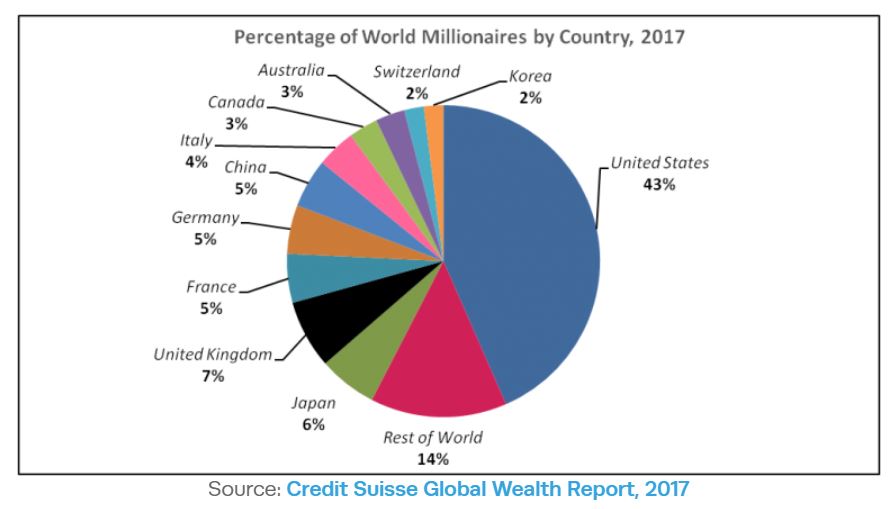

This idea of wanting to take full ownership of one’s career and financial path is a hallmark, I would suggest of the millennial generation that I find very different from when I started out on my own career path given the number of millionaires we have in the world today. Being disrupters of industry and gaining significant wealth in the process has been something repeatedly seen in places like Silicon Valley and elsewhere. In 2017, Western and European countries hosted the lion’s share of the world’s millionaires with more than 70 percent of the world’s millionaires residing in Europe or North America.

It is also refreshing to know that it is not all about the money for some individuals, despite their ability to generate great wealth. So like history saw in the 60s, There are those committed to living less material-consuming lifestyles with fewer financial obligations.

It is also refreshing to know that it is not all about the money for some individuals, despite their ability to generate great wealth. So like history saw in the 60s, There are those committed to living less material-consuming lifestyles with fewer financial obligations.

Pension Shortfalls & Picking Up The Slack

Whether you are in the early stages of your career or much further on – and because we now know that people are increasingly living much longer lives on average, it is important to ensure you have adequate savings and investments in place for the longer term. There is plenty of research warning us that most of the world’s population will be impacted by a pensions or savings shortfalls . So the question is, what you are doing to close the gap to ensure you can maintain the kind of lifestyle you want whenever you chose to work less or not at all? Don’t make the mistake of thinking that planning for your retirement is always something that can wait till much later or you will miss the opportunity of cultivating a great habit and attitude towards handling money if you fail to start early.

So, here are a few things to consider with your retirement nest egg in mind:

- Pay You First. I would recommend reading ‘The Richest Man In Babylon’ which is a short enlightening book that will shift your thinking about proactively saving and putting your money to work. Also check out Kenneth Doghudje’s ‘12 wonderful benefits of paying yourself first’. He’s an enthusiatic educator about money and building wealth.

- Diversify Your Income Sources. What you want to avoid is a situation where your reliance on a single income stream puts you (and your dependents) in an extremely vulnerable position if that income ceases. Having more than one income source (whether it is income from additional business or investments dividends for example) needs to be a serious consideration to act upon. Here are some good reasons to diversify your income sources.

- If you already have a pension(s) or investments in place, it is worth having regular discussions with a trusted professional to discuss their performance and any recommendations for action like making voluntary pension contributions for example.

- Document a Financial Plan. Whether you are in a serious relationship or single, it makes good sense to document a basic financial plan that you can follow through on and review as you go. I have found it a very helpful capturing my existing assets and liabilities to help me understand where my financial gaps/challenges are.

- Having a Will Makes Sense. While getting these done makes good sense, getting a will done can be seen as being in bad taste. However, they are extremely important to have in place if you own assets so that they are protected and distributed according to your own wishes.

#TalkLearnGrow