“Investing with confidence isn’t about predicting the market—it’s about knowing what to expect and having a strategy you can stick with when emotions show up.”

A calmer approach to building wealth: align your risk in dollar terms, reduce the noise, and follow a strategy you can stick with through market swings.

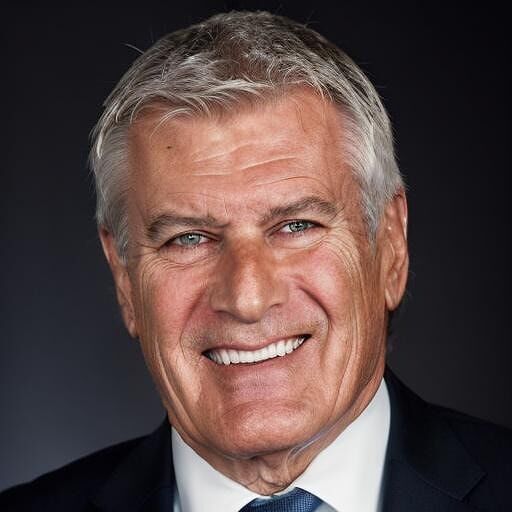

If investing makes you feel anxious, you’re not “bad with money.” You’re human—wired to treat uncertainty as threat, and losses as danger. In Stacey Chillemi’s conversation with institutional investor Andrew Parrillo, the theme that kept surfacing was simple but powerful: confidence comes from knowing what to expect—and building a plan that fits your real tolerance for risk before the market tests it.

Below is a deeper, Thrive-style breakdown—using Andrew’s framework from the interview and the way he explains his process and principles on ParrilloInvestors.com—translated into practical steps you can apply without hype, jargon, or constant second-guessing.

Why investing triggers anxiety even in highly capable people

Andrew describes the perfect storm:

- Too many inputs (headlines, hot takes, “breaking news” market commentary)

- Too many unfamiliar terms (which can make smart people feel behind fast)

- A brain bias toward protection (we fear losses more than we enjoy gains)

That last point is well-established in behavioral finance (often called loss aversion): people tend to experience the pain of losses more intensely than the pleasure of equivalent gains, which helps explain why normal volatility can feel emotionally intolerable.

The mindset shift: stop trying to “feel certain”

A subtle but important reframe Andrew repeats:

You don’t need certainty to invest well.

You need a durable strategy and realistic expectations.

He uses a blunt metaphor: everyone has a plan until they get “punched in the mouth.” Markets eventually deliver that punch—sometimes with a steep drop, sometimes with long stretches of boredom, sometimes with scary headlines that tempt you to abandon your strategy. The goal isn’t to avoid emotion—it’s to design a plan that still works when emotion shows up.

Parrillo’s “two-step” calm-investing framework

On his site, Andrew lays out a clear two-step process designed to replace vague labels (“conservative/moderate/aggressive”) with something more concrete: risk and return preferences expressed in dollar terms.

1) Determine your risk tolerance and return appetite

The first step is a brief questionnaire (described on his site as powered by a partner tool) that generates a risk score and frames risk/return preferences in dollar outcomes over a defined horizon—rather than personality-style labels.

Why this reduces anxiety:

Your nervous system calms down when “risk” becomes specific.

Not: “The market could be volatile.”

But: “In a difficult six-month stretch, I could reasonably see my portfolio drop by about $X—and I can still stick to the plan.”

2) Calibrate your portfolio to match your personal risk level

The second step is to assess the current portfolio’s risk profile and adjust it so it aligns with the risk score—then create longer-term projections and an investment policy statement to guide decisions over time.

Why this matters:

Most people don’t panic because the market is down.

They panic because they’re down more than they expected, for longer than they expected, with no plan for what to do next.

The “three things you can control” strategy

Andrew’s advice (in the interview) is unusually practical because it focuses on what’s actually controllable:

1) Costs

You can’t control returns. You can control many of the costs that quietly eat compounding over decades. His website echoes the importance of managing expenses as a fundamental principle.

A helpful reality check: even small annual fees can compound into large opportunity costs over time, which is why fee awareness is part of “investing with peace of mind,” not just financial optimization.

2) Diversification and simplicity

Andrew repeatedly emphasizes broad exposure (owning “a little of everything”) rather than chasing the “fastest horse.” His website similarly points readers toward low-cost, diversified vehicles and away from market timing.

This is consistent with the broader evidence that many active managers fail to outperform their benchmarks over time.

3) Your reactions

This is the big one. Headlines and volatility are unavoidable, but your process can protect you from impulsive decisions.

A practical boundary: many “best days” happen near “worst days,” so trying to dodge fear can mean missing rebounds. (The exact stats vary by study and timeframe, but the pattern is consistent: timing mistakes are costly.)

Build an “Investment Policy Statement” for your future self

Andrew mentions creating a statement of investment policy as a guardrail you revisit over time.

Here’s a Thrive-friendly version you can write on one page:

- Purpose: What this money is for (retirement, flexibility, education, etc.)

- Time horizon: When you’ll need it (and what portion must stay stable)

- Risk in dollars: “In a rough six-month period, I can tolerate a drawdown of about $___ without changing course.”

- Allocation rule: What you hold and why (broad stocks, some bonds/cash based on horizon)

- Rebalance rule: On a schedule (e.g., annually) or when allocations drift beyond a set range

- Volatility rule: “When markets drop, I wait 72 hours before any change and reread this policy first.”

This turns panic into a protocol.

What to do this week: one calm step forward

Andrew’s “first step” is essentially: set yourself up at a reputable platform with low-cost options, understand the basic differences between stocks and bonds, and keep it simple.

Here’s a non-overwhelming version:

- Pick your time horizon (10+ years, 5–10, under 5).

- Decide your “risk in dollars” (what drawdown you can truly live with).

- Automate a contribution you can sustain.

- Choose a simple diversified approach that matches the horizon.

- Set a checking schedule (monthly or quarterly, not daily).

Reflection: peace of mind comes from alignment, not predictions

Andrew’s core message—across the interview and his site—is that calm investing is less about being a market genius and more about being the chief investment officer of your own life: clear on your risk, disciplined about costs, and committed to a strategy you can hold through inevitable uncertainty.

The real win isn’t never feeling fear.

It’s building a plan that still works when fear arrives—so investing becomes a source of stability, not stress.