Our relationship with money is never just about money. It’s inextricably linked to our life experiences, so when you get to know someone’s money philosophy, you get to know them on a deeper level.

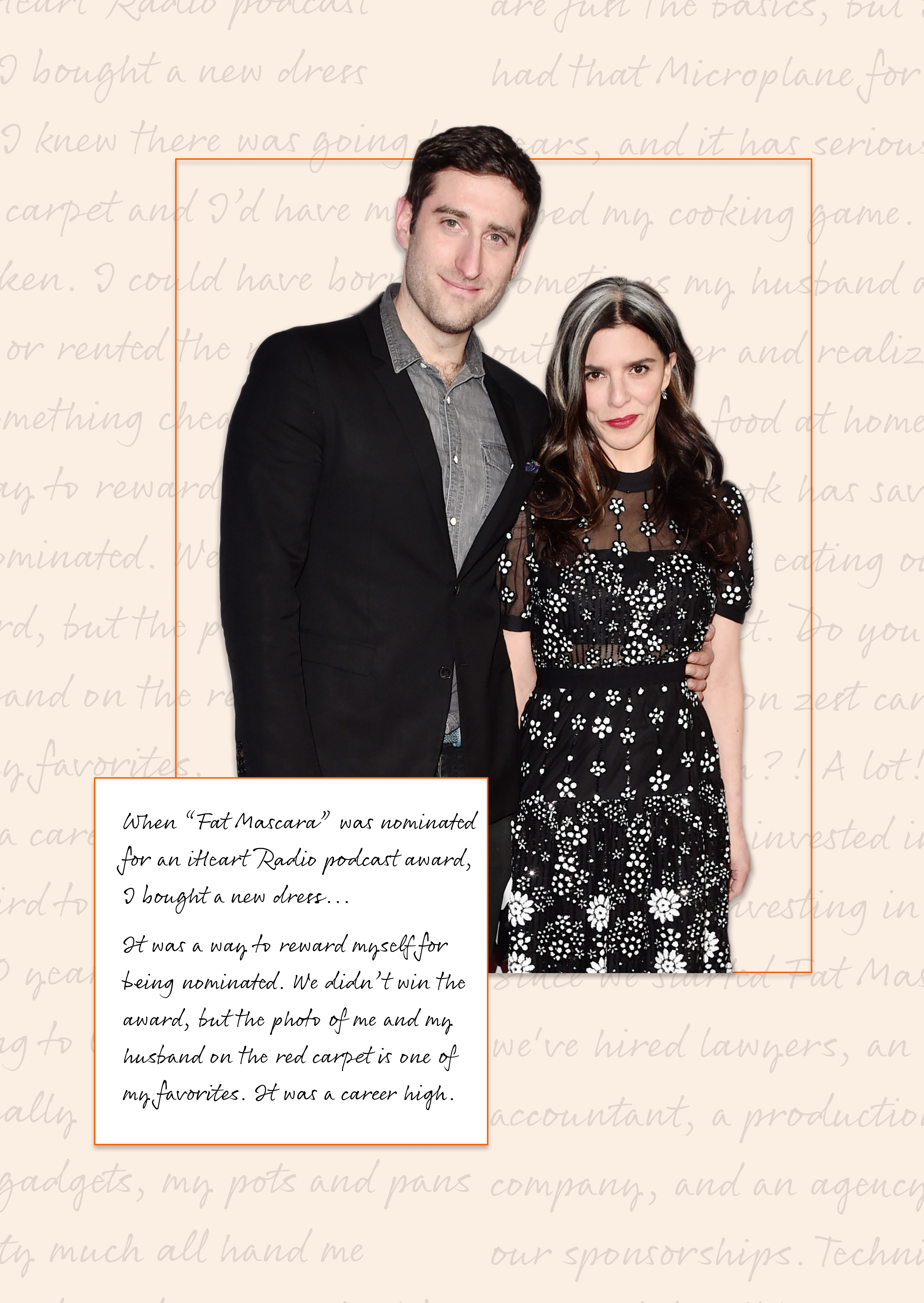

Thrive Global asked Jennifer Goldstein and Jessica Matlin — co-hosts of the cult-favorite podcast “Fat Mascara” — to take a break from dishing about beauty and skin care to open up about their personal journeys with money. The close friends and business partners (both N.Y.C.-based magazine writers/editors) share their first memories about money, the purchases they’ve never regretted, and the small but meaningful ways they continue to invest in themselves and their well-being — even in tough economic times.

Thrive Global’s Alexandra Hayes: What’s one of the first memories you have about money?

Jessica Matlin: I was around 8 years old at a pool party. One of the dads rocked up in a brand new Porsche, and in my memory, it seemed like all of the adults lost their minds. All of the other dads abandoned the barbecue area, the moms left the sun loungers, and even the older kids pulled themselves out of the swimming pool, all clamoring onto the hot driveway to see the car. I didn’t know what a “Porsh-sha” was at the time, and when I saw the car, it didn’t look like anything I had seen, even on T.V. It was only later on that I learned the car was very expensive, and that this man and his family were “well-to-do,” a polite way of saying that they had money.

Jenn Goldstein: I vividly remember my piggy bank! It was a big, pinkish-purple paper mâché pig, and I loved putting money in it, then doing a monthly dump, counting up the change, and depositing it in my savings account at the bank. The teller would always let me take a bunch of extra deposit slips, which I would use to “play office” when I got back home.

I’m a very practical person, and I’ve always approached money in a practical way. My parents weren’t rich — my mom was a teacher and my dad was a camera operator for the local news station — but they were excellent savers and investors. I don’t think I ever saw my mom buy something full price; she was a coupon clipper and loved to hunt for bargains. My dad was always really open about explaining our family’s finances and teaching me that money is something that should “work” for you.

Alexandra: Can you recall a time when you felt financially unstable — and how you were able to invest in your well-being and happiness during those times?

Jessica: When I was 21, I moved to New York as a magazine’s beauty assistant with a starting salary of $26,000 and about $300 in the bank, which I naively thought was a decent cushion. When I got my first paycheck and realized it covered only about half of my rent — and I had student loans to pay — reality hit. At my next job, I made $30,000 — but this time my new boss encouraged me to find freelance jobs to help supplement my salary, so I spent my weekends in my teeny apartment writing press releases and articles without a byline. Also, my roommate and close friend — who was always pretty money-savvy — inspired me to next-level my knowledge about finances. She had Suze Orman’s book, Women and Money, which blew my mind. Finance has always felt like some sort of elite fraternity to me, but Suze made the subject easier for me to understand. No matter where I’ve stood financially, I’ve always invested in my relationships. I feel happiest when I’m truly feeling a real connection to someone, and I don’t think it’s a coincidence that my most successful jobs or ventures have come out of those friendships, whether it’s one of my closest friends from college or a publicist I always had a laugh with at meetings. Investing in those relationships has been critical to my career and happiness.

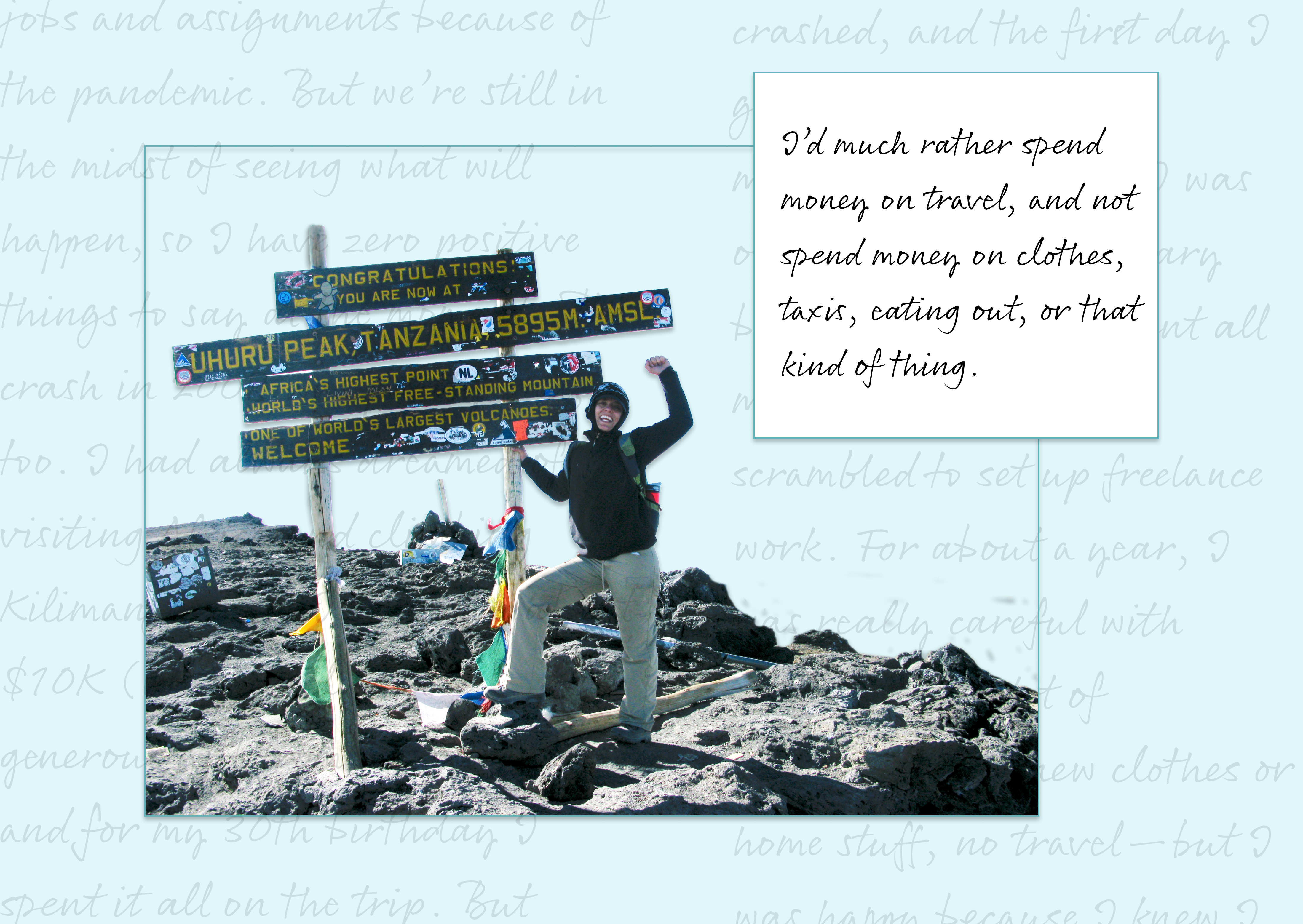

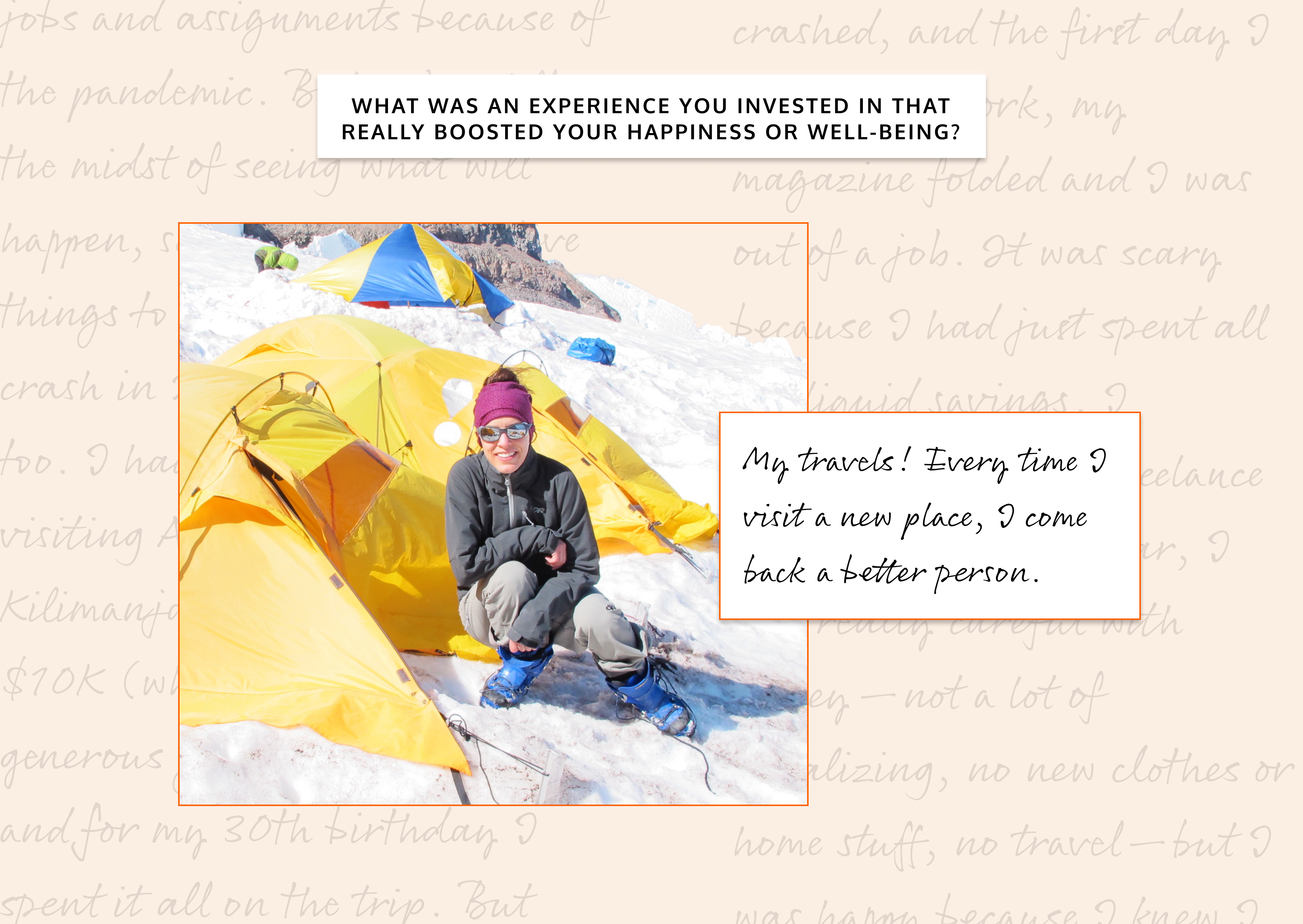

Jennifer: Umm, now. I’m a freelancer and I’ve lost jobs and assignments because of the pandemic. The crash in 2008 was pretty bad, too. I had always dreamed of visiting Africa and climbing Kilimanjaro, so I saved up about $10K (which included a generous gift from my parents) and for my 30th birthday I spent it all on the trip. But while I was in Tanzania, the stock market crashed, and the first day I got back to work, my magazine folded and I was out of a job. It was scary because I had just spent all my liquid savings. I scrambled to set up freelance work. For about a year, I was really careful with money — not a lot of socializing, no new clothes or home stuff, no travel — but I was happy because I knew I was doing the right thing. My sense of well-being came from knowing the strategy would pay off later. And I felt so grateful for all those memories from the trip to Africa. I didn’t regret it for a second. I’d much rather spend money on travel, and not spend money on clothes, taxis, eating out, or that kind of thing.

Alexandra: What questions do you ask yourself before you make a big purchase?

Jessica: If I have the luxury of time, I wait a couple of days before making the purchase. If I’m still thinking about it two days later, then it’s worth revisiting. This almost always works and prevents any ridiculous impulse buys. This rule does not apply on vacation! To this day, I still regret not buying this huge decorative wooden swan I saw in Vienna.

Jennifer: I think about whether the purchase will benefit me in the long run. If it’s travel, I think about what I’ll learn, who I’ll meet, if I could write about the trip someday, what long-term happiness it will bring me — that kind of thing. And if it’s something material, I picture myself justifying the purchase to my mother. If I can’t justify it, then I know it’s probably not worth it.

Alexandra: Tell us about some financial investments you’ve made in yourself that have impacted your well-being in a positive way.

Jessica:

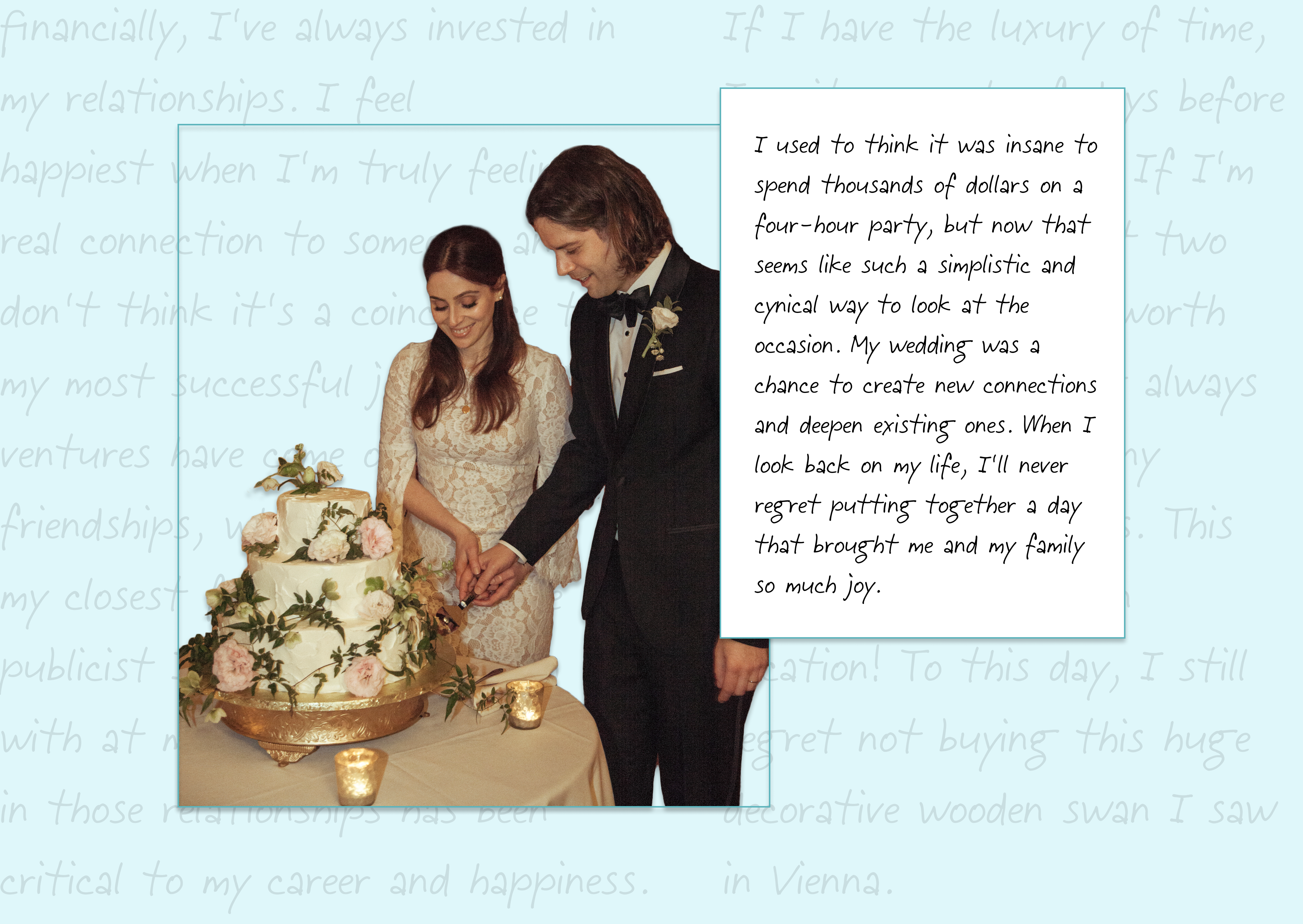

My wedding: I used to think it was insane to spend thousands of dollars on a four-hour party, but now that seems like such a simplistic and cynical way to look at the occasion. My wedding was a chance to create new connections and deepen existing ones. When I look back on my life, I’ll never regret putting together a day that brought me and my family so much joy.

Corrective eye surgery: I’d worn glasses since the second grade (contacts since the fifth), and my vision continued to deteriorate for nearly 30 years. Once it was stable, I looked into corrective eye surgery, and finally took the plunge in 2015. It was an absolute fortune ($10,000), but it was one of the best decisions I ever made. I’m not at 20/20, but I’m pretty close.

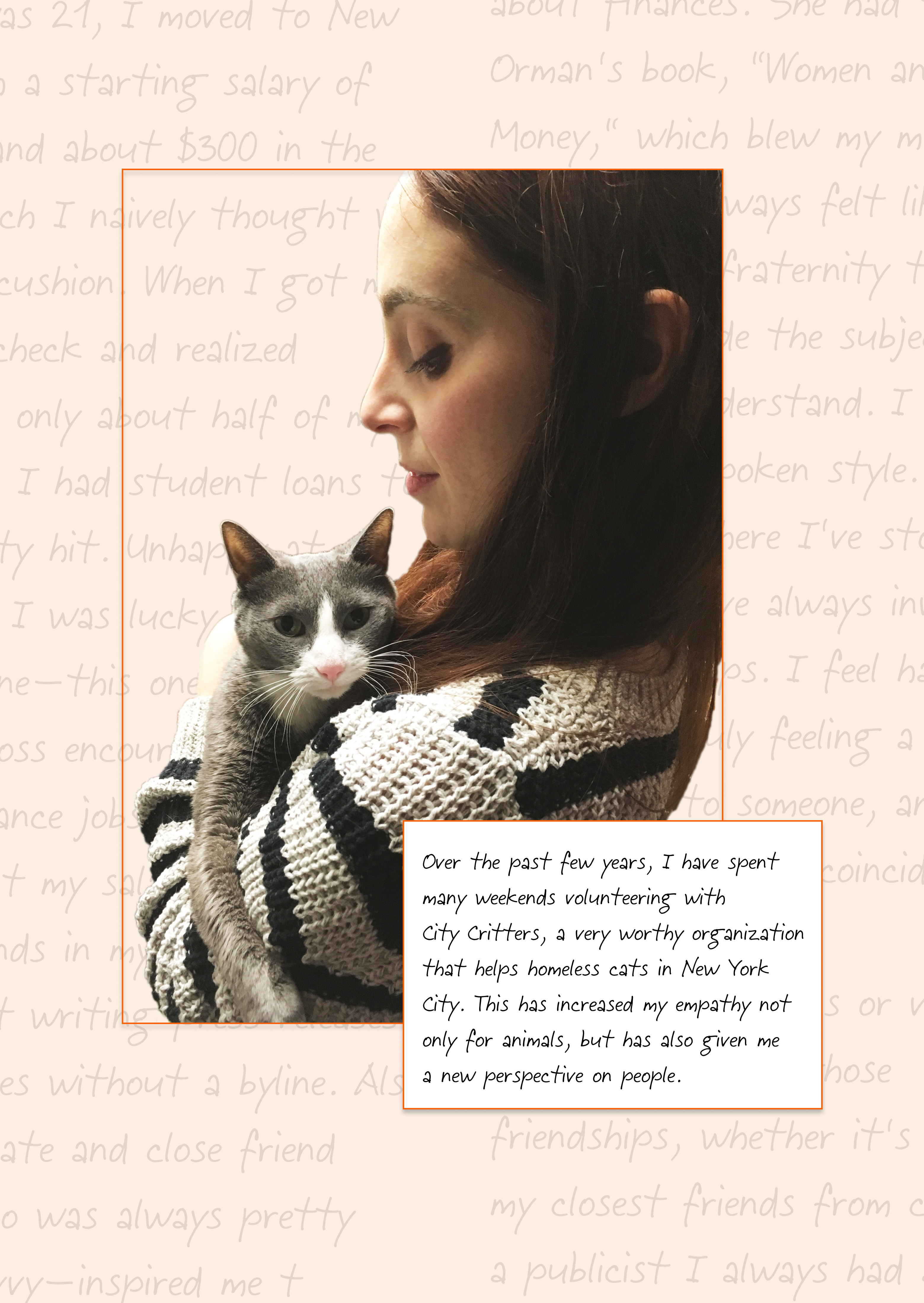

Volunteering: Over the past few years, I have spent many weekends volunteering with City Critters, a very worthy organization that helps homeless cats in New York City. Of course, I feel great about donating regularly to organizations like the ASPCA, Peta, Soi Dog Foundation, Animal Hope and Wellness, and Farm Sanctuary. While donating money is always a wonderful thing, this extensive hands-on experience has been more valuable than writing a check. Volunteering has increased my empathy not only for animals, but has also given me a new perspective on people — good and bad. We hear so many stories. Meals on Wheels is another one that I have a deep personal connection to, which is why I donate. With so many more older people in isolation, out of work, and wondering where their next meal is coming from, Meals on Wheels needs our support more than ever.

Jennifer:

Mountain climbing: I spent about $3K on a mountaineering course that included a summit attempt of Mount Rainier, the tallest mountain in the Cascade Range. During the trip, I learned so much — not just practical stuff about mountaineering, but how to work as a team, how to persevere, how to be patient. I was one of the students who was able to summit, and the feeling was priceless. I would have spent three times as much.

My home: In my early 30s, I bought a condo with my ex-boyfriend, but after years of living together I became unhappy in the relationship. The thought of ending the relationship and having to move out and sell the condo was devastating. But I moved into temporary housing and convinced a bank to give me a huge loan and a new mortgage to buy his half of the purchase so I could own the condo by myself. It was the best thing I’ve ever done.

Giving back. When I first moved to New York, I wasn’t sure how to handle all the requests for money that you get from the homeless on the subway. So about 10 years ago, I set a rule: I’d give a big donation to the Coalition for the Homeless at the end of each year. Well, not big, but the donation adds up to about $1 for every time I’m asked for money throughout the year.

Another organization I support is the A.C.L.U. I can’t claim to be healthy and happy knowing that many of the systems that benefit me are actively harming others. So I donate to organizations like the A.C.L.U. because their work helps to uphold voters’ rights and fight systemic racism in the education, immigration, and criminal justice systems. If that’s not an investment in “well-being,” I don’t know what is.