Our relationship with money is never just about money. It’s inextricably linked to our life experiences, so when you get to know someone’s money philosophy, you get to know them on a deeper level.

Thrive Global asked Josh Gondelman, a writer and producer for the late night show “Desus & Mero,” to open up about his personal journey with his finances. Here, he shares his first memories about money, a customized checklist that helps him determine if a purchase is “worth it,” and how in the face of a global pandemic and demonstrations against police brutality, he’s more focused on giving than ever.

Thrive Global: What’s one of the first memories you have about money?

Josh Gondelman: Maybe not my first, but an early one is from when I was about 8 years old and my parents said that it was time for me to have an allowance, which was very exciting. I was hoping to save up for a Nintendo Game Boy. I proposed one quarter per week, which I thought was a reasonable allowance based on some children’s book I read that had been written 30 years earlier. My dad very generously countered with $3 dollars per week, which I graciously accepted (even though it felt like an awful lot of money) because it would allow me to get the Game Boy 12 times faster.

TG: Describe your general relationship with money now — how has it changed throughout your life?

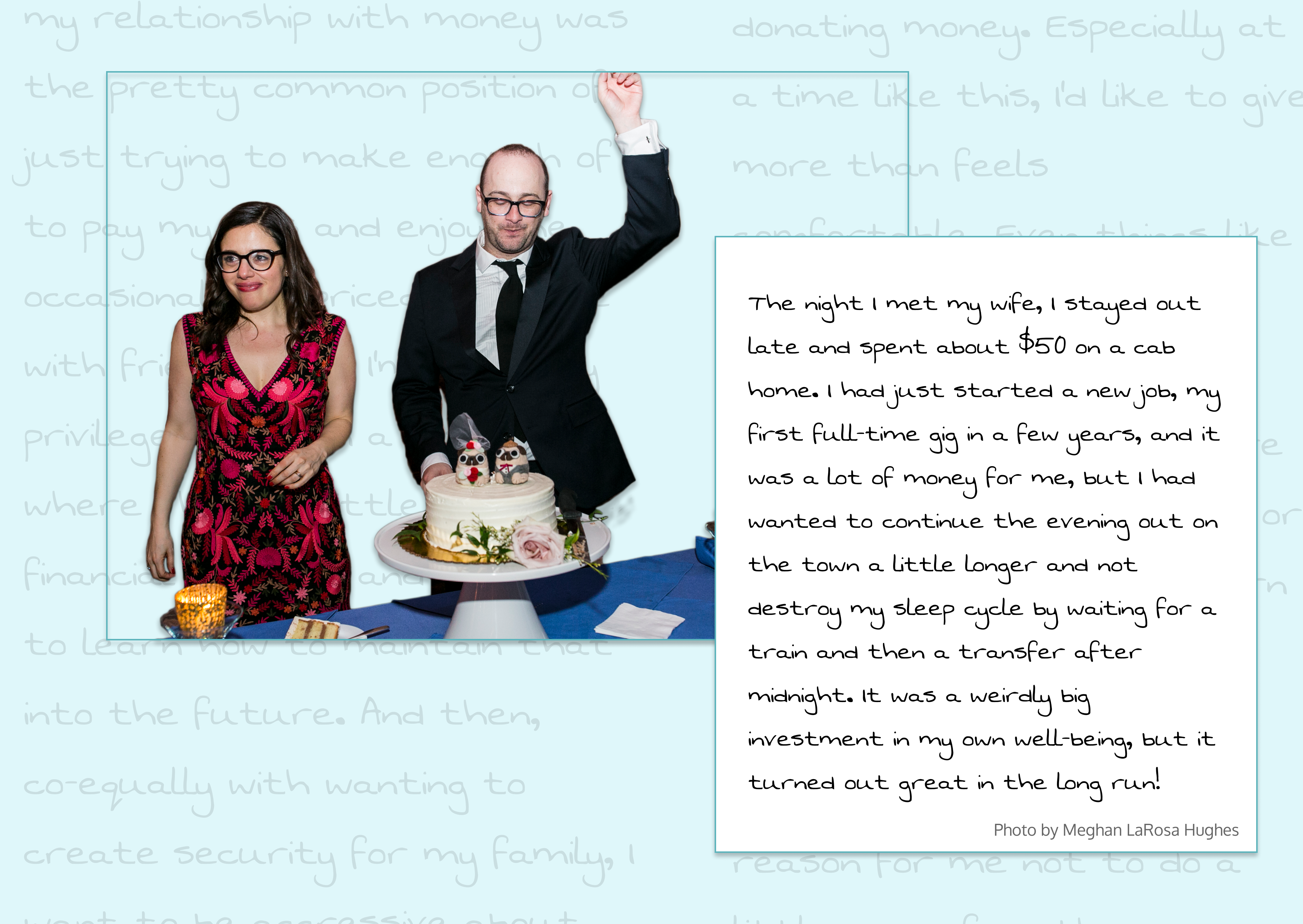

JG: For a big chunk of my adult life, my relationship with money was the pretty common position of just trying to make enough of it to pay my bills and enjoy the occasional overpriced beverage with friends. Now I’m incredibly privileged to be in a position where I have a little more financial stability and am trying to learn how to maintain that into the future. And then, equally with wanting to create security for my family, I want to be aggressive about donating money. Especially at a time like this, I’d like to give more than feels comfortable. Even things like tipping extra for delivery is something that I’m being mindful of doing. There were times when the extra five or 10 dollars was a real concern for me, but now I’m in a position of relative abundance, and there is no reason for me not to do a little more for others.

TG: What questions do you ask yourself before you make a big purchase?

JG: First, it’s: “Do I have the money? Will it create a hardship to spend this much?” And then it’s: “Do I need it?” I recently ordered a new laptop because I’ve been doing so much work from home, and my old computer was starting to do that thing where it stops working as well so you’ll be forced to buy another one (not to be too conspiratorial). Even though it’s a relatively big purchase, I know I will get a lot of use out of it.

The third question, usually for a less essential purchase, is: “Will I think about the money every time I use this thing? Will I constantly be trying to extract the value out of it that I put into it?” If the answer is yes, it’s probably not a good purchase, because it’ll cause me more stress than enjoyment. If I buy a new sweater, and I’m constantly thinking, “This better be X dollars comfortable and stylish!!!”, I’m probably better off buying something a little more affordable.

TG: Tell us about some financial investments you’ve made in yourself that have impacted your well-being in a positive way.

JG:

An important cab ride: The night I met my wife, I stayed out late and spent about $50 on a cab home. I had just started a new job, my first full-time gig in a few years, and it was a lot of money for me, but I had wanted to continue the evening out on the town a little longer and not destroy my sleep cycle by waiting for a train, and then a transfer, after midnight. It was a weirdly big investment in my own well-being, but it turned out great in the long run!

Giving back: I’m trying to do better about donating and contributing money to worthwhile causes even when it feels a little uncomfortable, especially now with the pandemic and with so many worthwhile organizations (and individuals) demonstrating against police violence. There’s so much emphasis on saving money when you have some, but equally as — if not more — important is putting money towards the good of your community and towards people with acute needs. I haven’t been able to be out in the streets as much as I’d like, so I’ve been extra mindful to really take a stand financially and be supportive of the values that I hold.

Little, but life-changing, conveniences: For like… I don’t know, $5, I purchased a second stick of Old Spice deodorant to leave in my travel toiletries bag. I don’t know why, but it felt like an outrageous rubicon to cross to own two deodorants. So for years, I just had one, and moved it from my medicine cabinet to my luggage whenever I left town. Now I live a luxurious, two-deodorant lifestyle. Similarly, I spent $18 to get a second USB cord for my phone that lives in my backpack so I don’t have to remember to take the one from my bedside when I go on the road. Sorry to flaunt my prosperity in your face, but this is the kind of opulence I am accustomed to now.

TSA PreCheck: The $80 or so I spent on TSA PreCheck was both incredibly useful and incredibly fraught. I’ve written about it before, but I’m both constantly grateful for it and constantly resentful of it.