If you are feeling a bit — or a lot — more stressed than usual, you are not alone. Navigating through a pandemic has led to a sharp uptick in our collective stress levels. And for many Americans, financial worries are top of mind. In fact, 82% of individuals feel that the COVID-19 pandemic has had a bigger negative impact on their financial stress and well-being than any other event in recent history, according to a Thrive Global original survey of 1,000 Americans.

Reducing and managing our stress is key to setting ourselves up for better financial, emotional, and physical health. After all, unchecked stress levels have been linked to health issues from heart disease to diabetes, according to the American Psychological Association. To learn more about the science behind financial stress and how you can manage it, click to watch the video above.

The good news? There are plenty of simple, actionable strategies that can help you take control of your finances and look after your whole-human well-being. Read on to understand the exact ways that money woes manifest in our minds and bodies, and learn Microsteps — small, science-backed actions you can start taking immediately — that can significantly ease your stress.

Money worries can impede cognitive function

Simply thinking of being financially stretched can cause cognitive capacity to plummet, according to 2013 research from Princeton University. It turns out, worrying about money — even without opening a bill or checking up on your accounts — can monopolize brain space.

What you can do: While you might think that avoiding your finances keeps stress at bay, that strategy could lead to more stress in the long run. Instead, try facing your financial situation in small doses. Gaining a clear-eyed view of your reality will help you reduce stress and help you manage your finances.

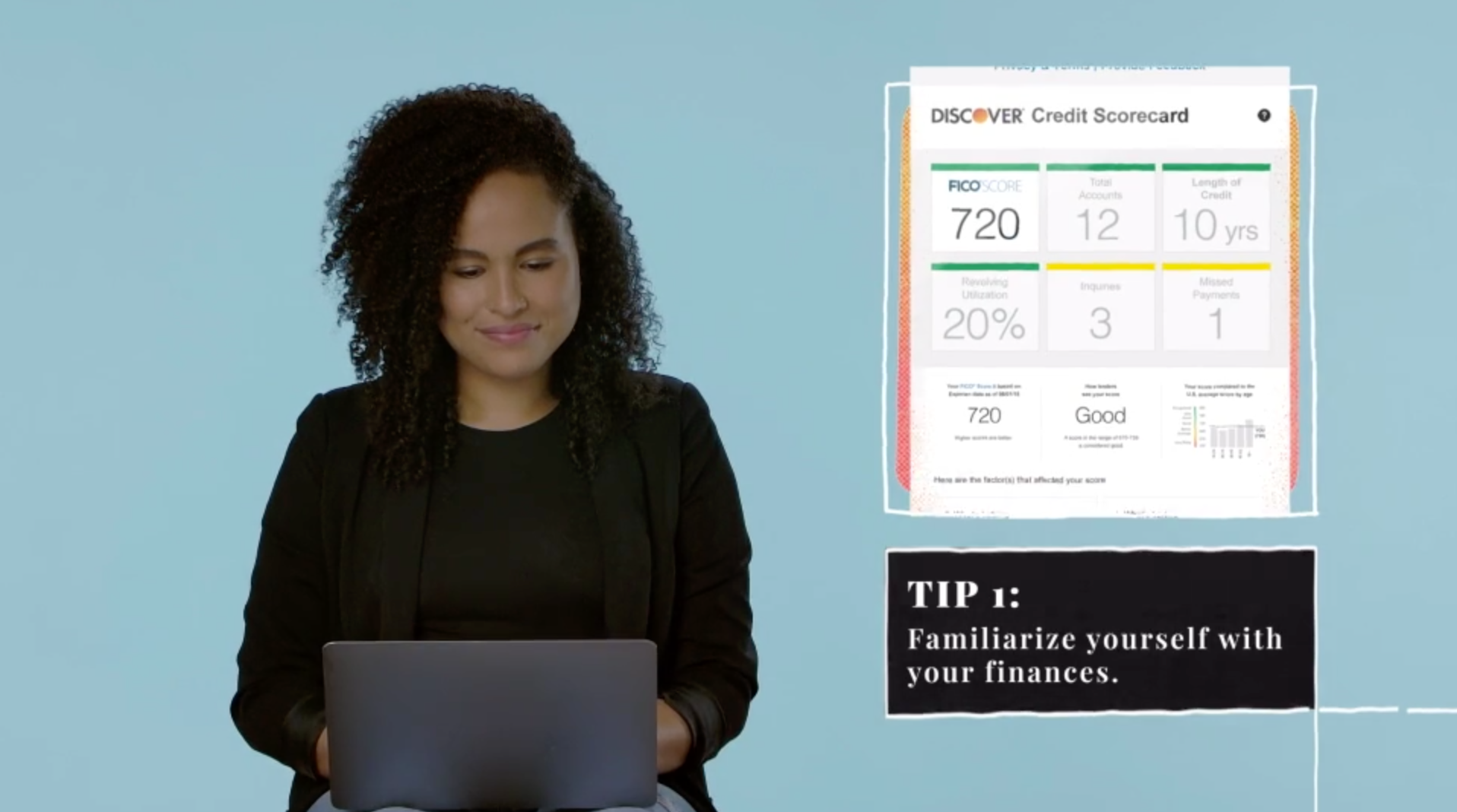

Simply taking a few minutes today to check the status of just one bill, account, or report, like your credit score, is a great place to start. Your credit score is particularly important to stay on top of, as it comes into play during many of life’s big moments, like taking out a loan, renting a home, or trying to get a credit card. The best part? Checking your credit score is pretty painless. There are easy, free tools, like Discover’s Credit Scorecard, that can help you check your FICO® Credit Score for free, even if you’re not a card member. To learn more about Discover Credit Scorecard, click here.

Microstep: Once a month, check your credit score. 90% of top lenders use FICO® Credit Score, so set a calendar reminder to get a quick picture of your financial well-being.

Financial stress can increase inflammation in the body

You hear a lot about inflammation and the havoc it can wreak on your health, but what do finances have to do with it? It turns out, money stress can contribute to higher concentrations of inflammatory proteins, or cytokines, in the body — which, over time, can hamper our body’s ability to fight infection as well as increase our risk of heart disease and other conditions.

What you can do: If money stress is causing you to ruminate on negative fantasies for the future, one of the best things you can do is to interrupt your thoughts. Rumination might feel productive, but it’s associated with anger, depression, and anxiety, and can affect sleep quality. Instead of fretting about what hasn’t happened yet, try focusing on current bright spots, no matter how small. For instance, have you been able to cut back on any spending during the pandemic — say, on a gym membership, or commuting to work — that you’ve been able to redirect toward a savings account or paying off a loan? Training your brain to look for the wins instead of the obstacles can go a long way toward protecting your emotional and financial health.

Unsure of how your spending has changed during the pandemic? If you have a Discover card, using Discover’s Spend Analyzer tool to track your spending is an easy way to do it. The tool allows you to view your card activity within a given time frame, and shows you a chart of how you’re spending by category, such as grocery stores or gas. With the tool, you may notice where you’ve naturally been cutting back, or where you may want to make some additional adjustments.

Microstep: Take a few minutes to reflect on how your spending habits have changed during the coronavirus crisis. Use this time as an opportunity to evaluate what you didn’t need to be spending on and what you want to invest more in.

Feelings of financial insecurity can cause you to overlook your health Seven in 10 Americans who feel financially insecure say that they don’t look after their health as much as they should. And research from Thrive Global shows that 89% of millennials have cut spending on activities that support their well-being, like self-care or therapy.

What you can do: While it makes sense to trim your finances during tumultuous times, cutting back on well-being can hurt your health in the long run. If you stopped spending money on your health and well-being, try practicing self-care on a budget. Luckily, there are many small and affordable well-being practices that can make a big difference in our overall health. For instance, if you’re tempted to skip a doctor’s appointment with your favorite out-of-network provider, look for someone in-network who accepts your insurance. If you’ve stopped prioritizing nutritious meals, try meal-prepping and getting creative with low-cost (but still healthy) ingredients.

Microstep: One night each week, take a few minutes to plan out your meals for the week ahead. With this method, you won’t have to stress over last-minute meal planning or overpriced takeout.

Keep these solutions in mind as you continue to navigate the pandemic, and remember, improving your personal finance and your overall well-being is possible — and starts with steps that are smaller than you might think.