What did we learn from the recent Wall Street debacles? What “short squeeze is?” No. That “break-it-down” memes across social media do a terrible job at explaining things? No. That Subreddit’s power supersedes that of institutional traders? Also no. We learned that – you guessed it – Elite Academia & Institutional Education miss the mark on incorporating personal & business finance into our journey to becoming functioning — dare I say THRIVING — young adults.

Although I was fortunate enough to attend a great public high school, graduate from the #1 business school in the world, and receive my MBA from one of the most prestigious universities, none of these credentials actually provided me with even a cursory understanding of financial literacy from a real-life perspective. Is that embarrassing? Yes. Am I the first to admit it? Also yes. I was literally getting straight A’s in my corporate finance courses at 19. I even did so well on my finance assessments in grad school that I managed to ace-out of my classes’ final exams. I had every bit of theoretical expertise, ahead even of my classmates who were interning at Goldman Sachs, and absolutely 0 applicable knowledge of the material I was “learning” in order to practically implement it in my life and career.

Most of what dBu Edu’s Financial Literacy & Leadership Program teaches DOES NOT come from textbooks (hallelujah). Sure, the lesson plans & curriculum are designed by Wharton graduates & are business-school-derived. But the secret-sauce comes from experiences that I and my network of successful executives & entrepreneurs have gone through and witnessed over time. All of this is to say — We cannot replicate experience. But we can accelerate it. We do so with deliberate reinforcement through two of our three touch-point pillars: Mentorship + Hands-On Learning (i.e. internship/apprenticeship). 1:1 Instruction is the other pillar.

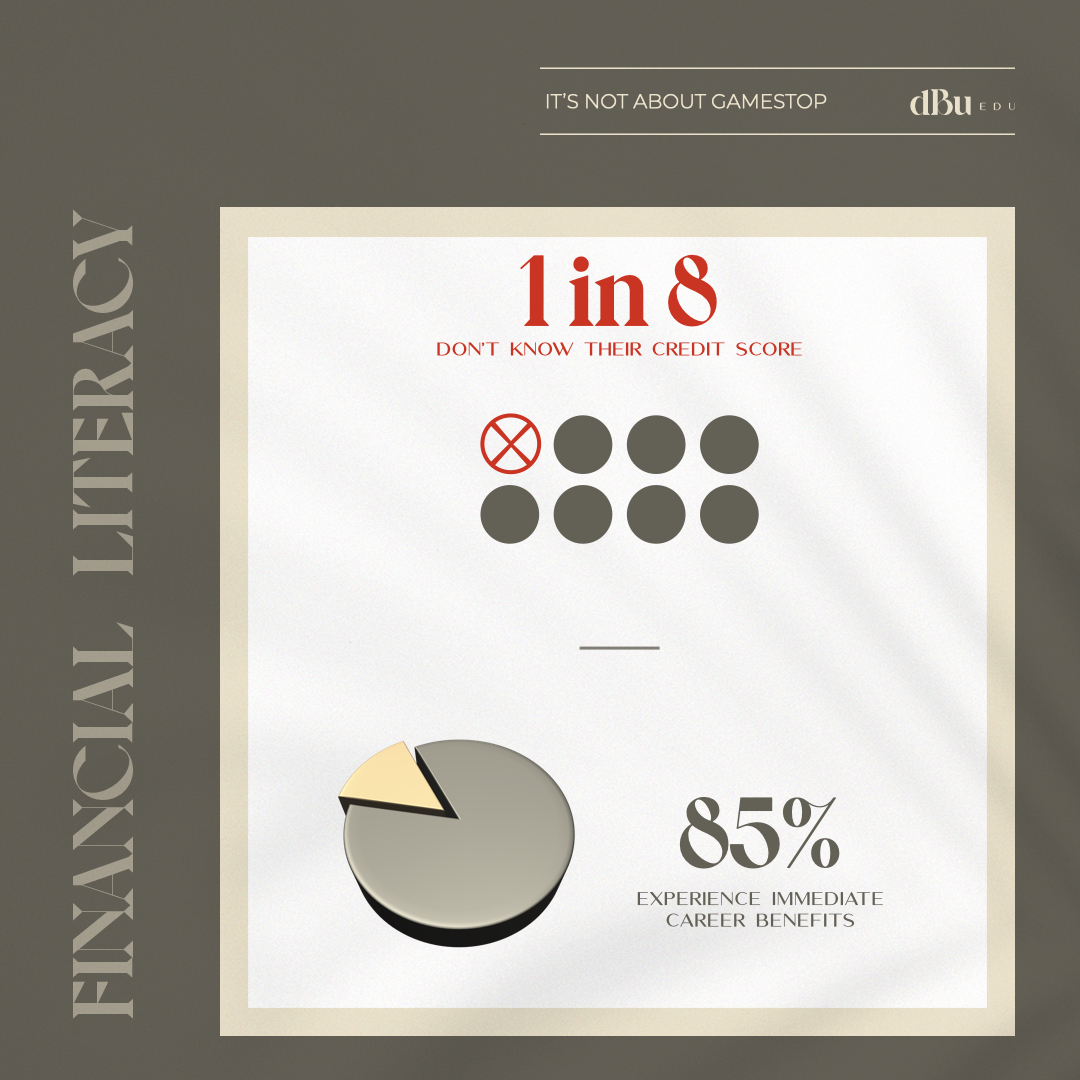

It’s mind-blowing that institutional education, even in the “elite-est” echelon of private schooling, has no mandate on rudimentary financial literacy at all. Young adults enter “real-life” completely unversed, devoid of knowing what we don’t know, in a world where personal & business finance fundamentals are essential for any semblance of success & security – for anyone, anywhere, on any educational path, entering any occupation.

My goals with this program specifically are to provide Gen-Z with exposure, relevance, fundamental principles, and most of all, curiosity & tools to learn more about all-things-finance. We encourage actual learning, in a way that supports both academic + career goals, and that also speaks to students’ own personal passions, strengths, & topical interests.

Every few years, Financial Crises infiltrate the Zeitgeist. Pop culture & Financial Literacy intersect, share a cover on some tabloids, and it becomes trendy to throw around ‘fin-AHNCE’ jargon and brag about your Sharpe Ratio. Then what?

Finance & Investing is not the study of money or markets. It’s the study of how people behave with money. Financial Literacy, then, all starts with mindset (and we have an entire module called MONEY MINDSET for this reason). The goal is to:

- Assess and understand one’s own current state, patterns of thinking, spending, goals etc.

- Elevate ongoing cognizance and self-awareness around Value, behavior, financial health, & planning.

From a Meta-Learning & Emotional Intelligence perspective, I believe strongly in the omnipotence of KNOW THYSELF – everything else follows.

“[Our] secret-sauce comes from experiences that I and my network of executives & entrepreneurs have gone through and witnessed over time.”

Unfortunately, the public’s interest in Financial Literacy wanes as quickly as those arbitrage opportunities. Gen-Z’s access to information, savviness around micro-learning, & habits of consumption lends itself to the possibility of a momentous shift towards a Financial Literate generation. But right now, it’s devolved into more “Robinhood-bro, get-rich-quick” discussions and less “understand fundamentals of Finance, make sound long-game decisions, build generational wealth.” There is a (detrimentally short-lived) difference.

It doesn’t help that the current landscape of financial comprehension is polarized — heavily ‘all or nothing.’ Asking an expert to explain concepts then reading Investopedia all day is feasible. But with that expertise comes a deluge of assumptions about baseline knowledge, disconnect from a beginner’s mind, and lack of the expert’s interest or understanding about contextual application within each student’s industry/topic/career of interest. If we’re talking technical analyses, disengagement is directly proportional to irrelevance. So you’re still left with very few learnings & even less interest to learn more.

And so transpired dBu Edu’s Financial Literacy & Leadership Program’s trifecta model to improve contextual learning (i.e. the practice of applied learning through real-life context – combining conceptual & experiential). Practical knowledge application in topics/careers that spark interest = solution to reduce intimidation, increase transparency, & generate higher engagement. The younger the students enroll to start, the greater their compound interest opportunity. Ultimately, our Success Roadmaps help students to ‘Know Thyself’ through Tangible & Transferable Life Skills. Because we cannot replicate the benefits of experience. But we can accelerate it.

IG: @dbuedu || www.dbuedu.com