Single women homeownership has been on the rise for the last several years.

Not just on the rise—Single women homebuyers have actually risen above male homebuyers in 2019 and 2020.

According to the Census Bureau, single women own more than 1.5 million more homes than single men do in America’s 50 largest metro areas.

It’s a trend that’s growing fast, especially across major cities. In the last quarter of 2020, single women bought 9% more homes than they did a year earlier, according to a national report by Redfin. To put it in perspective, that’s twice the growth rate of purchases among single men.

But what’s caused this change to happen so rapidly, and why are women outpacing men?

Well, there are a lot of factors to consider. Socially, women aren’t expected to marry or have children in their early twenties, allowing them to explore their careers and life as a single person.

“Over the last several decades, we have observed that women are excelling in their careers, getting married and having children later and are determined and driven to reach their goals — qualities that can breed success when it comes to home buying,” said a report from the National Association of Realtors.

The NAR report rings true in many ways. The modern woman is successful, career-minded and is, at many times, more financially savvy.

Last year, Urban Wire reported that half of households are now headed by women. In fact, they’re actually outpacing men in this area—From 1990 to 2019, the share of households headed by single women increased from 17.6 percent to 22.6 percent.

According to that report, over the last three decades the share of households headed by women increased 17 percentage points. By 2019, households headed by women accounted for half of all households.

In cities, single women are even more likely than single men to own a home. Last year, LendingTree found that single women own more than 1.5 million more homes than single men do in America’s 50 largest metro areas.

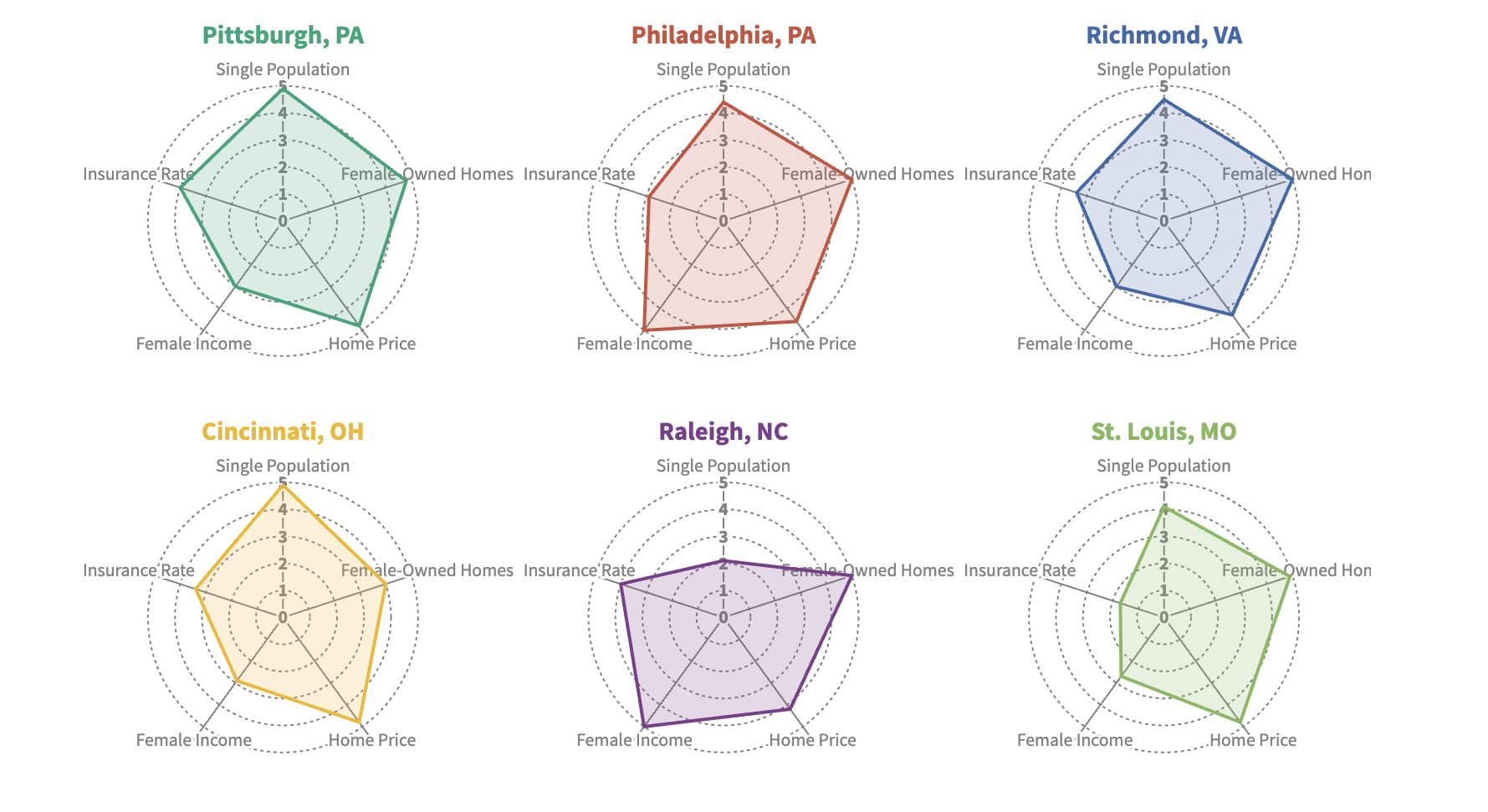

A 2021 report from DeedClaim determined New Orleans, Raleigh, Memphis, Philadelphia, and Little Rock have the highest share of single female-owned homes per capita of any city in the country.

The report, which used data from the Census Bureau, found that both single female income and single female-owned homes per capita are highest in Raleigh, Philadelphia, and Richmond as well.

To put it in perspective, women in these cities have more wealth and own more homes than most women in major cities across the country.

The explanation to the increasing amount of wealth in single women not only derives from sociological factors like children and careers, but psychological factors as well.

Nicole Middendorf, a financial adviser and certified divorce financial analyst, puts it well: “Women tend to be more conservative, which is good when buying a house,” said Middendorf in an NBC article. “Men often try to stretch it, but women, being more risk-averse, don’t stretch themselves to buy a home they can’t afford.”

Women tend to be more risk-averse than men, a trait that explains the financial responsibility of a modern single woman.

Between financial savviness, risk-aversion, and a strong career focus, single women are taking the housing market by storm with no signs of slowing down.