Being in debt, not earning enough money, the cost of raising children, or even being married to someone who isn’t excellent with money may all cause financial stress.

You’ll be able to focus on other essential aspects of your life and relax knowing you have a strategy in place to deal with your financial position if you can decrease your financial anxiety. Here are some things you can do right now to ease your financial stress.

Create an Emergency Fund

An emergency fund is a savings account designed to meet unforeseen costs and financial crises. Although a car repair can be expensive and stressful, if you know you can draw into your emergency fund to handle it, a lot of the worry will go away. It’s also simpler to stick to your budget if you know you have extra cash in the bank to handle the unplanned.

Until you are debt-free, you should have at least $1,000 in your emergency fund. Then you should save away three to six months’ worth of living costs.

Until you are debt-free, you should have at least $1,000 in your emergency fund. Then you should save away three to six months’ worth of living costs.

Putting together an emergency fund might be difficult at first, especially if you are trying to make ends meet month after month. Begin by setting away a modest amount each month, whether it’s $10 or $100, to build up your emergency fund. You may also sell any unwanted goods around the house to get some cash as fast as possible.

Make a Financial Plan

You may feel overwhelmed and believe that creating a budget would simply add to your financial stress, but it is the most effective tool you have for gaining control of your finances and eliminating money worries.

A budget enables you to plan when and how you will spend your hard-earned money. This budget ensures that you have enough money to pay your current costs while still working toward your savings objectives. It can also assist you in locating more funds to apply to your debt.

A budget enables you to plan when and how you will spend your hard-earned money. This budget ensures that you have enough money to pay your current costs while still working toward your savings objectives. It can also assist you in locating more funds to apply to your debt.

The first few months of budgeting and adhering to it might be difficult, but if you know what to do, you can frequently cut down on the time you spend on it, and therefore cut down on the time you spend worrying about money.

Get help from your circle

If you’re having trouble getting a grasp on your budget and spending problems, don’t be hesitant to seek outside assistance. Contact with your friends or relatives. You may enrol in lessons on basic money management and investment, which will assist you in creating a budget and completing the tasks necessary to achieve financial success.

A financial planner may also assist you in developing a long-term saving and investment strategy to help you care for yourself.

A financial planner may also assist you in developing a long-term saving and investment strategy to help you care for yourself.

If you’re drowning in debt, a credit counselling agency can assist you with reorganising your debt and, in certain circumstances, negotiating with creditors. You may also enrol in financial classes to learn about budgeting and other elements of personal finance.

Figure out what you can change

If you’re facing financial problems, it might be due to a lack of income, excessive spending, or a mix of the two. Decide what you can do to alter the situation if you know you don’t make enough money to keep up with your present bills. It might include alternatives like returning to school in order to qualify for a better-paying career.

If you’re facing financial problems, it might be due to a lack of income, excessive spending, or a mix of the two. Decide what you can do to alter the situation if you know you don’t make enough money to keep up with your present bills. It might include alternatives like returning to school in order to qualify for a better-paying career.

If you believe you have a spending problem that is a compulsive habit, you may consider attending a specialist group or seeking professional treatment to cope with your problems. You should be able to reduce your stress once you have a plan in place to help you permanently change your situation.

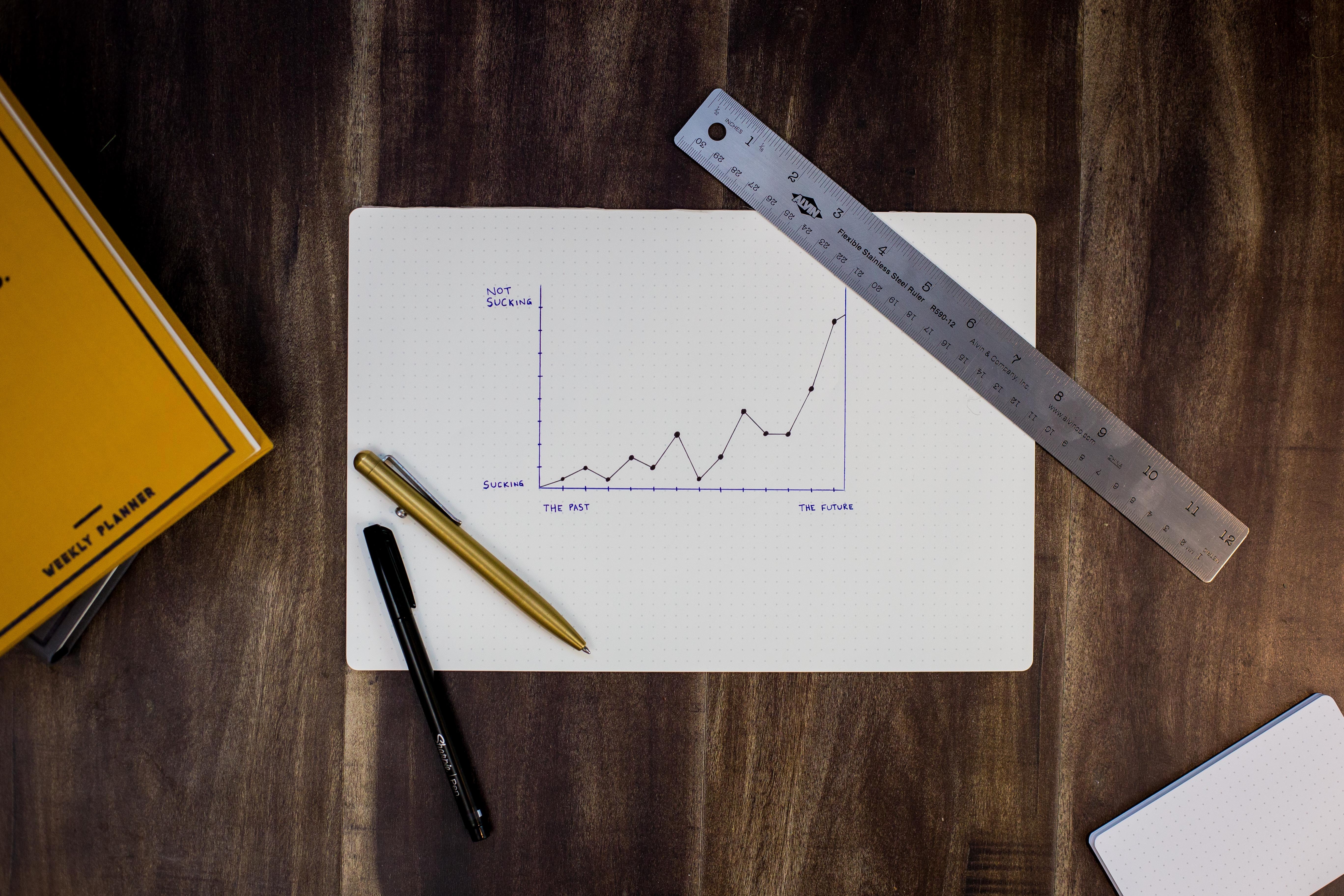

Keep track of your progress

While this may not appear to be a solution to your financial problems, it may significantly reduce the amount of stress you experience on a daily basis.

While this may not appear to be a solution to your financial problems, it may significantly reduce the amount of stress you experience on a daily basis.

Track your progress toward your financial objectives to find good elements of your financial condition. Looking at the bright side of your present financial circumstances might also help you relax.

Remember that you have the power to alter your financial position, and you will find it simpler to do so if you are not always concerned.