The story of success, whether it’s tangible or abstractly defined, always contains an instance where one assessed risk and was too motivated to stand idle. The passion inside propelled those in search of prosperity past discomfort, fear, or the negative consequences that faced them and bet on themselves. As in investing and in “rags to riches” narratives, to the victor goes the spoils.

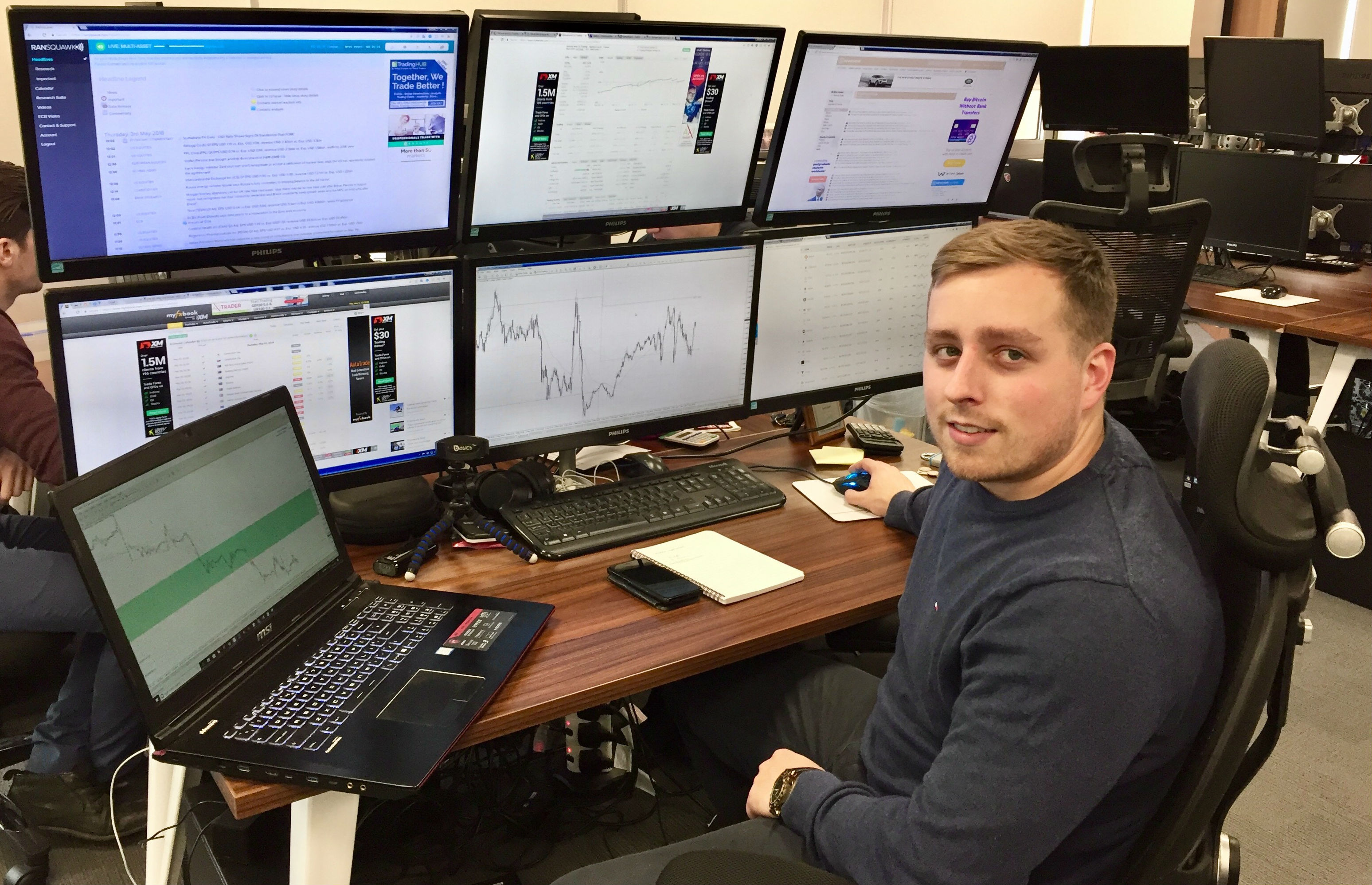

My name is Samuel Leach, from Watford, UK and I’m CEO and founder of Samuel & Co. Trading Company. I’ve turned my stock trading enterprise, which started in my college dormitory with student loan overage as my initial capital, into a 70-employee, multi-million-pound corporation all before age thirty. My goal is to retire at age 32 and focus more time on my charitable pursuits. I’m not where I am today if I had ignored what moved me and just gone through the motions of post-uni corporate ladder climbing. I did what we all should do; I trusted my gut and amplified my unsilenceable fascinations. By sharing my story, I hope to imbue you to align your actions with your inner algorithm and explore your passions with curiosity as your compass.

Like most children of my generation, I’m a product of divorce. Mum and dad were dedicating their wages to two separate single-income households for my brother and me; the financial burden overwhelmed my parents. Heightened by hardships of instability in the family dynamic, I spent my teenage years in a one-room shared with my sibling and father. Seeing how rapidly a family could go from a comfortable living situation to all-encompassing constraints, motivated me to take control of my monetary circumstances. I’ve managed to parlay my tribulations into triumphs.

With that said, I perpetually remind myself that no one is an entirely self-made person; my parents afforded me endless support and encouragement as they maneuvered through post-divorce troubled waters. Though I compensate them financially, I’ll never be able to repay them for raising me. Their belief in me gave me the reassurance to follow my dreams whatever they may be, which landed me at the University of Hertfordshire, where I was in the Marketing and Advertising program. After toiling in circular studies that I didn’t engage with, I started contemplating career and field changes. I researched what jobs made the most money and seriously considered working at an oil rig, had a requirement of 10 years experience been a hurdle I could lope over.

My desire to acquire abundant wages lead me to work in the financial sector itself. I quickly became obsessed with stock trading and the foreign exchange market. Understanding that I had the ambition, a willingness to learn, and work ethic to make it the calculated and volatile realm of making moves in the markets, I decided to gamble the two-thousand-pound bursary I had for my student expenses and trade. The wager I placed on myself with my college loan turned from two-thousand-pounds, into one-hundred-and-seventy-eight-thousand-pounds in less than a year.

While all this was happening, I took a summer internship at a local bank, which I leveraged into a full week’s worth of pay while just working a couple of days as I finished school. My entrepreneurial spirit led me to additional streams of income; after hearing about my rewards on the exchange, a few of my classmates paid me to teach them how to trade stocks. I was operating on all cylinders and reaching burnout. The stress of work, school, and side hustles became to be too much, and I focused all my efforts on trading.

Through trial and error, I eventually found what helps me excel in buying and selling shares; I created a strict system that I adhere too, I take emotion out of the decision equation, and I doubled down on my instincts. My passion is to operate at my highest level and utilize my inner algorithm as a formula for resolution.

Minimizing risk and detecting whether or not trends benefit you is a part of trading and any passion pursuance. You have to strive to establish an unwavering comprehension of your position and devise a method to your madness. Though it may feel trite at first, materialize a doctrine of what mobilizes your interests and showcases your acumen, and you’ll profit in a multitude of ways.

One of my soundest investments was in a smaller tech company that made internet streaming video television that would rival Apple TV. After I read a press release stating that the startup landed an order of half a million units, contingent on passing a safety evaluation, my interest was piqued. I researched the firm’s earlier dealings and discovered that they’ve previously passed every inspection. The deal for the palm-sized boxes was sure to come to fruition. For my initial investment, I laid down ten-thousand pounds, and in three days, my stake was worth one-hundred-and-ten-thousand pounds.

Having a sixth sense of what press releases are trying to sell to the public is not a prerequisite to successful trading. Still, it can aide in determining whether a company is signaling towards a bright horizon or implore you to avoid the company because of its coded messaging. My reward for pursuing my passion was not only in the fiscal sense but also in the notion that I harnessed my intuition and research and turned them into assets readily at my disposal.

Whilst elements of my background and my outlook on methods to maximize your prospects may ring true to you in some aspects; I understand that not everyone is ready to follow their dreams and navigate territories unfamiliar to them in business. To those, I say, asses the risks of you sailing stagnant waters years from now. Will the channels you traverse eventually lead you to a sea of opportunity? Haphazardly, you will find yourself dedicated to a position, one that’s a pseudo-fulfilling best-case scenario, if you keep your career arch on an unsubstantial bend. Still, if you evict yourself from your comfort zone, you are better set up to live a life surrounded by exhilarating challenges, growth, and purpose.

Chase down what drives you, and you’ll always head in the right direction.

Follow Samuel on his Website and Medium