The gold bull market has begun, according to gold veteran CEO Rob McEwen, the chairman and Chief Investor of McEwen Mining. It began as rallies typically do… sneaking in like Santa Claus. The gift gold has already brought investors is a 32.6% ROI on the price of gold itself, with gold mining ETFs, like iShares RING, doubling since 2016.

The World Gold Council explained the increased appetite for gold in their Mid-Year Outlook for 2019. They wrote.

Traditionally, bond holdings provide diversification and hedge [investors’] stock market investments. But both high- and low-quality bonds are expensive as yields have generally fallen and credit spreads compressed since 2011. In fact, more than US$13 trillion of global debt is currently trading with nominal negative yields.

In other words, bonds are losing money. That’s not what you want the “safe” side of your nest egg to do.

International Gold

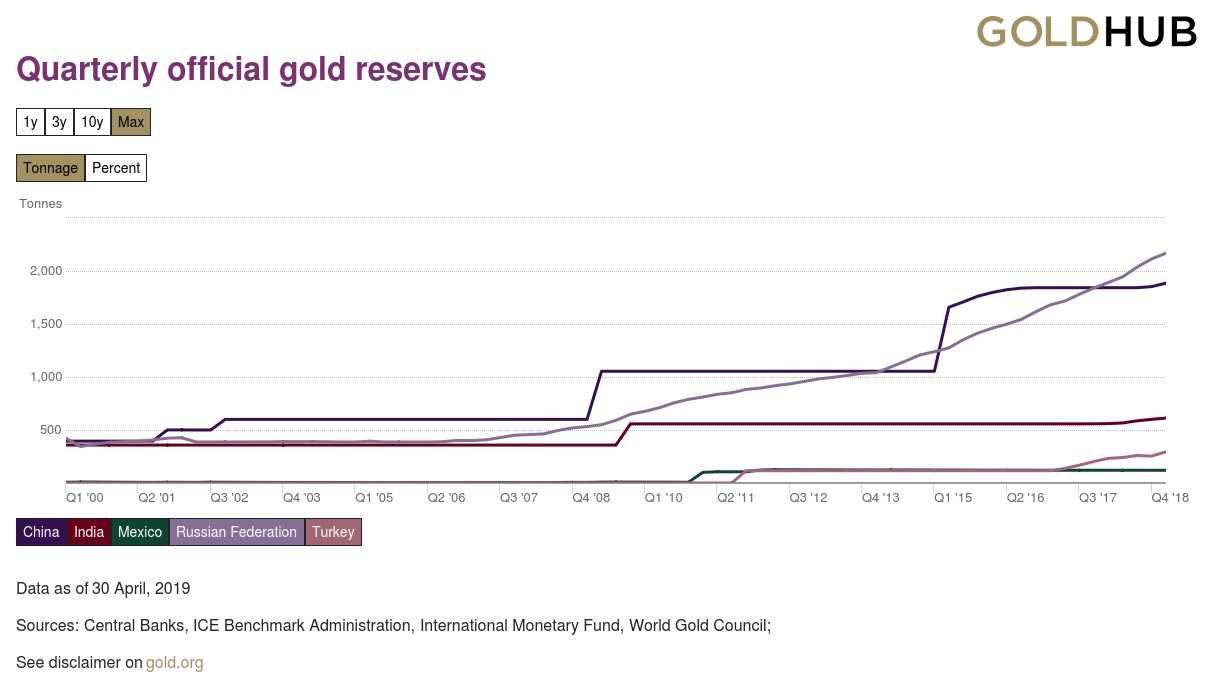

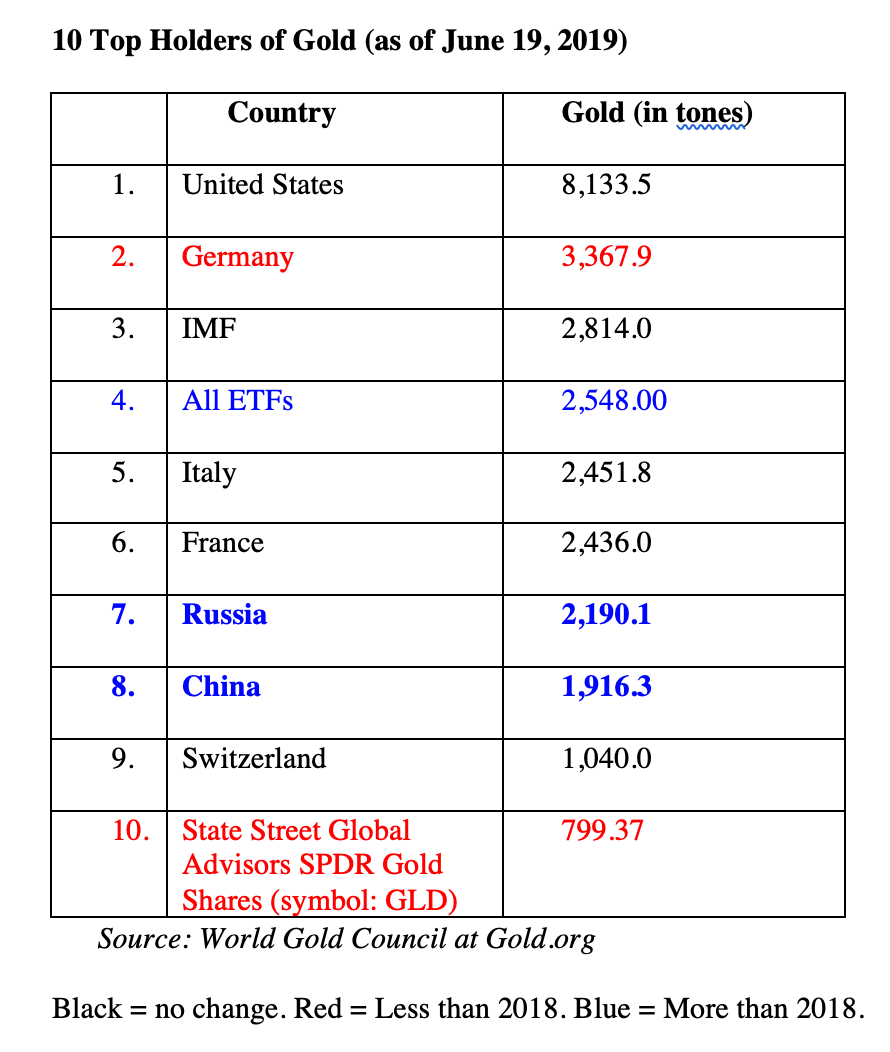

I should clarify that the rally began in the U.S. in 2016. The price for gold in other currencies has been higher for years. China, Russia and India have been on gold buying sprees. Russia rose from the 10th largest holder of gold reserves in 2012 to the 7th this year, knocking China down one position, even though China has been on a buying spree, too.

See the chart below for The Top Holders of Gold.

As I indicated in my blog on Russia last year, when the country dumped most of its U.S. treasuries and purchased a boatload of gold, Putin and China are very interested in breaking up the dollar’s hold on the global reserve currency. Both China and Russia believe that if their currency is backed by gold, it will feel more secure to other nations. China is taking various measures to create a Petroyuan (yup it already has a name) to trade oil in Chinese yuan, backed by gold. Bloomberg reported in January that Russia has ditched U.S. reserves in favor of the euro and the Chinese yuan. In an interview on May 18, 2018, Putin stated, “The whole world sees the dollar monopoly is not reliable; it is dangerous for many, not only for us.”

The Western World’s economists are quite concerned about China’s rise. Yesterday, at the 75th Anniversary of the Bretton Woods Conference in July 1944, French Finance Minister Bruno Le Maire told those gathered:

“Unless we are able to reinvent Bretton Woods, The New Silk Roads might become the new world order. And Chinese standards – on state aid, on access to public procurements, on intellectual property – could become the new global standards.”

The Global Economic Slowdown

Despite the global economic slowdown, China’s economy is predicted to grow by 6.2% GDP in 2019, compared to 2.1% in the U.S. and lower in Europe. Though few American politicians ever admit it, China has been the largest world economy for years now.

The departure of Christine LaGarde, from the IMF to the European Central Bank, means that the new IMF chief will be tasked with ensuring that the fund has enough resources for the next crisis. Many economists have been free with calling 2019 the “late stage of the business cycle,” so that eventuality could be sooner than many Wall Street investors think.

The Case for Gold in a World of Uncertainty

Rob McEwen says simply, “Gold is money.” (Be careful of purchasing coins, however. Many novice collectors end up paying far above the value of the coin, meaning gold would have to increase another 55% in order for the collector to break even when he walks out the door.) The ROI case for investing in gold miners is particularly strong – in the event that gold continues to strengthen – for many reasons.

- You are buying low. Many of the gold mining funds, like RING, are still trading at a discount of 58% or more off of their 2012 highs. Whereas the current price of gold, at $1405.40/ounce, is only 26% lower.

- You don’t have to store or insure the gold itself. (The company does that for you.)

- And the upside of buying low in the gold miners, can be triple that of the movement of the value of gold per ounce, as we’ve already seen since 2016.

There’s a lot of consolidation going on in the gold mining industry, and a lot of juniors who have been on the ropes for a while. So, a safer bet, in general, would be a gold mining fund. Of course, if you gamble on an exploration company, like McEwen Mining, that strikes a large, high-quality vein, you’ll be happy you did.

Be sure to listen to my full interview with chairman Rob McEwen of McEwen Mining from April of this year, discussing why his company had such a miserable quarter the first of the year, and why his goal is to eventually join the S&P500. Go to BlogTalkRadio.com/NataliePace to access it.