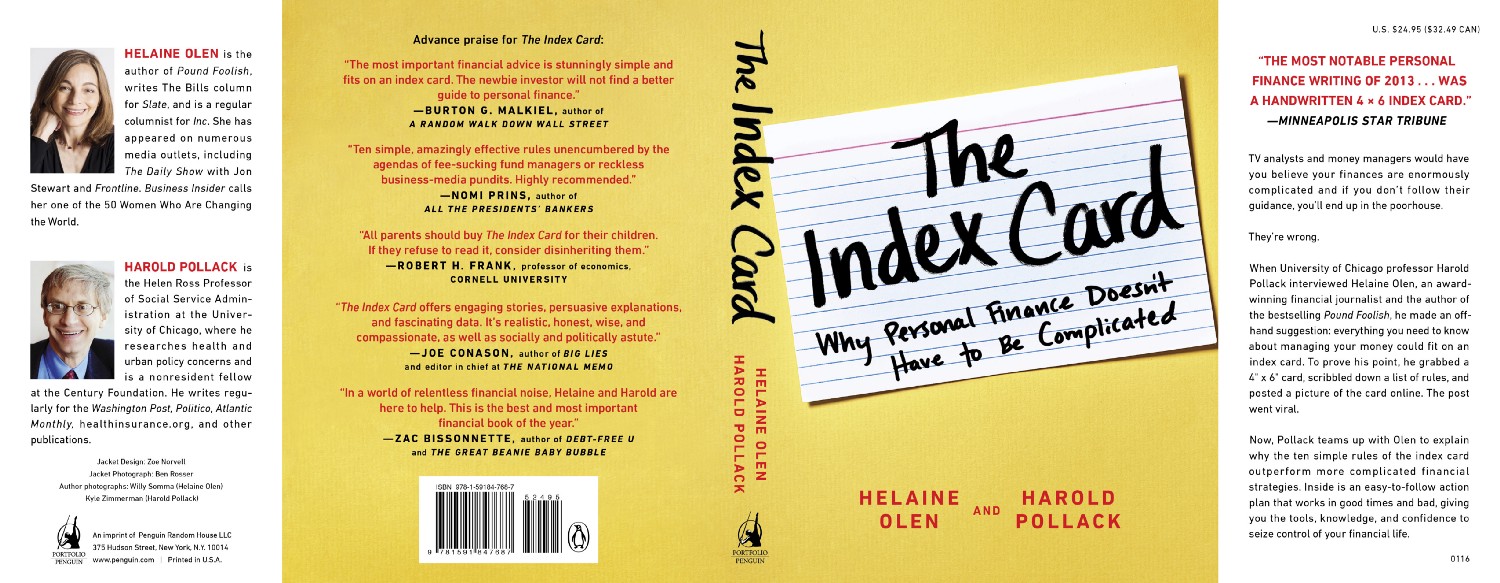

By Helaine Olen and Harold Pollack

The Federal Reserve estimates Americans owe $1.3 trillion in student debt. While people under forty are responsible for two-thirds of that debt, the amount owed by older people, even senior citizens, is soaring too. Studies have shown student loan debt affects everything from home ownership to marriage, even retirement. These loans that we assume to help train us for adulthood often end up determining it instead.

What’s more, many people sign up for student loans without paying attention to the actual loan, let alone the fine print. A recent study published by the Brookings Institution found half of college freshmen thought they had borrowed less money than they had. Among all first-year students with federal loans, 28 percent reported having no federal debt and 14 percent said they didn’t have any student debt at all.

Unfortunately, thanks to the fact that the cost of higher education has increased at a rate significantly more than the rate of inflation — not to mention our salaries — since the 1980s, many of us are not in a position to avoid taking out loans to pay for college. But there are things you can do to make the situation a bit easier.

First, know what kinds of loans you have. We can borrow money to attend college from either the federal government or private banks. It’s quite possible you have both types of loans. You should always borrow from the federal government first. Why? Federal loans offer much more flexibility than privately issued loans. There are different monthly payment plans based on income. In some cases you can defer payment if you return to school or are underwater financially. More generous options are available if you work in selected public service occupations too. The Department of Education provides an informative website, StudentAid .ed.gov, that runs through the options and fine print on student loans and where to go for help. Visit it.

The issuers of private student loans are much less for giving and flexible than the federal government. Unlike with federal loans, the interest rate does not need to be fixed. That leaves your financial life more than a bit uncertain. And if your income isn’t high enough to meet your private monthly student loan payments? Well, too bad. Sometimes the bank will help, and sometimes it won’t, and you won’t have much in the way of recourse.

As a result, this is a rare case where even if the amount owed on the federal loan is at a higher interest rate than your other bills, we’d strongly suggest you pay down almost every other bill you have before you take this one on.

Quick note about consolidating student loans: This can be very tempting. For starters, it allows you to pay one or two bills a month instead of making payments to what could be several different lenders. It also reduces the overall monthly payment, freeing up cash for other uses.

No-brainer, right?

Not quite. As with other consolidated loans, the lower monthly payment might well come at the cost of lengthening the term of the loan and increasing the amount of money you are going to pay over time.What’s more, consolidating federal student loans is, in the vast majority of cases, a onetime offer. There are no do-overs, unless you return to school and acquire more federal student debt. The best place to begin the process of figuring out if consolidation is right for you is to check out the Department of Education’s website. At no point should you turn to private counselors or services offering to help you reduce the load of your student debt repayments. According to a report issued by the National Consumer Law Center, these are almost always high-priced and fee-ridden consolidation services interested in padding their own bottom lines and less concerned about protecting yours.

One other potential pitfall: Do not combine federal and private student loans. Why? Once again, federal loans provide more flexibility in the event of financial hardship, and you will lose those benefits if you consolidate those loans with a private lender.

Finally, if you can’t keep up, don’t be an ostrich! Don’t go into default; that is, don’t simply stop paying your monthly bill. The penalty fees will pile up fast. Instead, look for help. A good place to start is the website of the Consumer Financial Protection Bureau, ConsumerFinance.gov, or the Department of Education. These sites offer unbiased guidance and tell you how to ask for help and what you need to do to receive it.

Helaine Olen is the acclaimed author of Pound Foolish: Exposing the Dark Side of the Personal Finance Industry, which was featured on The Daily Show with Jon Stewart and PBS’ Frontline. She’s a staff writer at Slate, where her column The Bills appears. In addition, she writes the Spread the Wealth personal finance column for Inc. Her work has appeared in numerous publications, including The New York Times, Salon, and the Los Angeles Times, where she wrote the popular Money Makeover column.

Harold Pollack is the Helen Ross Professor of Social Service Administration and is an Affiliate Professor in the Biological Sciences Collegiate Division and the Department of Public Health Sciences, as well as a nonresident Fellow of the Century Foundation. He writes regularly for the Washington Post, the Nation, The New York Times, New Republic, Politico, the Atlantic, and other publications.

Excerpted from The Index Card: Why Personal Finance Doesn’t Have to be Complicated by Helaine Olen and Harold Pollack with permission of Portfolio, an imprint of Penguin Publishing Group, a division of Penguin Random House LLC. Copyright © Helaine Olen and Harold Pollack, 2014, 2017.

Originally published at medium.com