Catalytic events are historical occurrences that cause important changes. How can you build wealth in the middle of one?

Life is filled with uncertainty, especially in times like this!

We find ourselves in the middle of a pandemic that has triggered an economic recession, escalated racial tensions and increased political instability. All of these factors have amplified financial anxiety which has inevitably taken a toll on our collective physical and mental health.

Analysis by the Institue for Policy Studies shows that since the pandemic started, a staggering $6.5 trillion in household wealth has disappeared and the collective wealth by billionaires has surged by more than $584 billion! Federal Reserve Chair Jerome Powell noted that “This is the biggest economic shock in the U.S. and in the world in living memory!”.

When catalytic events like a pandemic happen, they level the playing field and expose hidden opportunities, for those who can identify them.

As a career consultant, I have spoken to hundreds of unemployed and underemployed job seekers in the last few months who are desperate to provide for their families, put food on the table and have some measure of financial security. As a new dad myself, working towards the financial security and stability of my young family has been my biggest priority.

In this article, I will share with you my mindset, reasoning, and strategies to successfully build wealth in these strange times based on my personal experience and what has worked for me.

Catalytic Events & Timing

Catalytic events are historical occurrences that cause important changes.

The 9/11 terrorist attacks of 2001, the financial crisis of 2008 or the current COVID 19 pandemic are classic examples of catalytic events that are sudden, catastrophic and one for history books. Unfortunately, this is how history moves, never smoothly but always in bumps. When catalytic events like a pandemic happen, they level the playing field and expose hidden opportunities, for those who can identify them.

The natural reaction that most people have to a catalytic event is fear.

Fear is a natural emotion induced by perceived dangers or threats, this emotion causes physiological and ultimately behavioural changes aimed at fleeing, hiding or protecting one’s self from the perceived danger. Fear has its evolutionary role in protecting us, but giving in to fear is far from a winning strategy if you want to maximize hidden opportunities to build wealth.

To overcome fear, you have to visualize this pandemic as an opportunity to evolve and an excellent occasion to take initiative and “force the issue”.

We are in a crisis; a time of intense difficulty, mortal danger, confusion, anxiety and change.

“Moments of crisis show us that the ways we’ve been doing things actually hinder our existence,” says Michele Moody-Adams, a professor of political philosophy and legal theory at Columbia University. Think back to a pre-coronavirus world, when you’d ask why something was done in a certain way, the answer was often, “Because that’s the way it’s always been done”.

The rules are now changing, today we are now being forced to deeply consider everything and redefine what is normal. Nothing is no longer taken for granted, people are suddenly open to new ways of doing things from how we work, communicate and commute to how we shop and socialize. The rules are changing and this new reality ultimately creates an abundance of hidden opportunities for anyone who is looking.

Crisis creates new problems that you can solve.

During this pandemic, I have identified needs in areas of career and business coaching that has proven lucrative for me. People are willing to pay me to coach and guide them as they try to get a new or better job in this recession. Small business owners are happy to pay me to coach them as they try to grow their businesses and increase their revenue in an ever-competitive market.

Don’t give in to fear, choose to see this crisis as an opportunity to create a solution for one of the many problems that this pandemic has created.

Trust me, there are many problems out there in your local community, your industry, your country, and even across the world that you can offer solutions to. All you have to do is to observe what people around you are struggling with.

The law of Value

Your true worth is determined by how much more you give in value than what you take in payment — Bob Burg

In The Go-Giver by Bob Burg, Burg shares the simple yet mind-blowing concept of giving more in value than what you take in payment. The secret to getting ahead, building wealth and maximizing opportunities is by putting other’s interests first and continually adding value to others.

Once you have gotten over your fear of the pandemic and identified potential opportunities to create solutions, you have to focus on adding more value to others than what you ask in payment. This doesn’t mean that you are providing free services; rather, it means that your solution adds much more value in comparison to the payment you are asking. This is how to build loyal fans and customers that will support your solution and be an advocate.

For example, In the early days of my coaching business, I routinely reviewed many job seekers’ resumes at no cost and often provided free career consulting and access to my online course for those who truly needed it. I only asked for their honest feedback on the effectiveness of my methods and for them to share their experience with other friends who could use some coaching. They received more in value in comparison to the payment I requested.

I also did something similar when it came to consulting with small business owners, I focused on adding value to their business by helping them to increase their revenue and performance before asking for payment. This created true superfans who not only believed in my coaching but also became evangelists for me.

Furthermore, your compensation is directly proportional to the number of lives you touch. Your income is determined by how many people your solution serves and how well you serve them. It is not just enough to create solutions, you have to find ways to offer your solution to the most amount of people to become truly successful. The more the number of people you can help, the higher your earnings.

Taking Action & Managing Risk

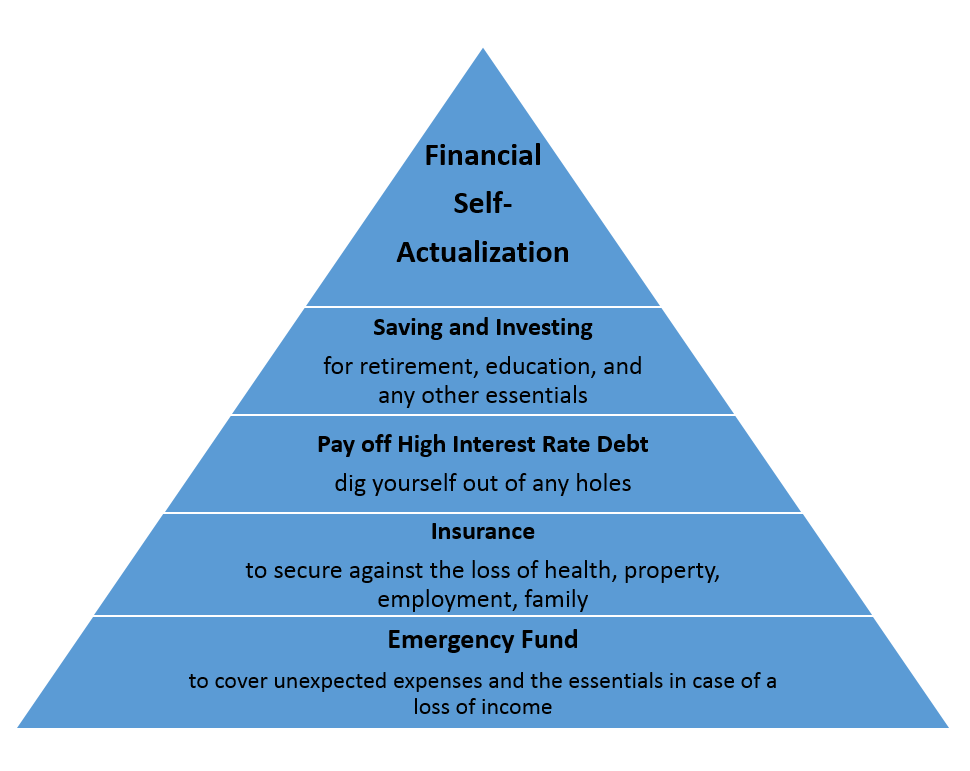

Maslow’s hierarchy of needs is a motivational theory in psychology comprising a five-tier model of human needs, often depicted as hierarchical levels within a pyramid. Needs lower down in the hierarchy must be satisfied before individuals can attend to needs higher up. From the bottom of the hierarchy upwards, the needs are physiological, safety, love and belonging, self-esteem and self-actualization.

Using this concept, we can apply it to finances and wealth creation. As you work towards overcoming your fear of this pandemic and you start to identify problems around you that you can provide solutions to, you have to manage your risk. Starting a side-hustle outside of your regular job is the best way to begin this journey and if there is any time to start, it is now! To learn more about side hustles, read Zulie Rane’s powerful article on the 3 steps she took to earning 6 figures at 25 years old!

Your priority as it relates to finances should be to make enough money through your side hustles that you can save for emergencies. Emergency funds cover unexpected expenses and the essentials (rent, food, etc.) in case of a loss of income. Once enough savings for 3–6 months has been saved, you should then focus on buying insurance products to secure you against the loss of health, property, employment or family. There are different types of insurance products for this.

Your next priority should then be paying off high-interest rate debts and digging yourself out of any holes. Debts like this include credit card debts, lines of credit etc. After this, you can then focus on saving and investing for retirement, education and any other essentials. This is how to achieve financial security and peace of mind. At this point, your side hustle(s) will help you achieve financial self-actualization and freedom.

In conclusion, the pandemic is a leveller and is changing the rules of what we define as normal. Don’t be afraid of this change, embrace it. Look for problems you can provide solutions to, it doesn’t have to be rocket science, it could be as simple as putting your woodworking or gardening skills to work, freelancing or teaching an online class. Then, grow your side hustle.

Hi, I’m David and I am on a mission to support professionals in their careers and entrepreneurship pursuits. I coach professionals and small business owners to build vital soft-skills, improve their emotional intelligence and earn more money. You can learn more about me at davidowasi.com.