Many people today are overwhelmed with their bills. We’re juggling school, family, soccer, test scores, skinned knees, taxes, college funds and our aging parents. Acckk! It’s easy to just get swallowed up by the system, which is one that will have you making everyone else rich at your own expense.

Part of the solution is to reduce your big-ticket bills. Smarter choices in housing, transportation, utilities and taxes will offer you savings of thousands of dollars annually. That’s a bucket list vacation each year! Learn more about those strategies in the 2nd edition of my bestseller, The ABCs of Money. Cutting out café lattes can save you a few hundred dollars, but it is not your ticket to financial freedom.

Another piece of the winning formula is to start earning money while you sleep. When your assets (home, retirement plan, savings, etc.) increase in value, everything becomes easier. Your assets to debt increase, which raises your FICO score. Your wealth increases.

You can read how investing was my springboard out of almost losing my home to a dream come true lifestyle in my book, You Vs. Wall Street. The math is simple.

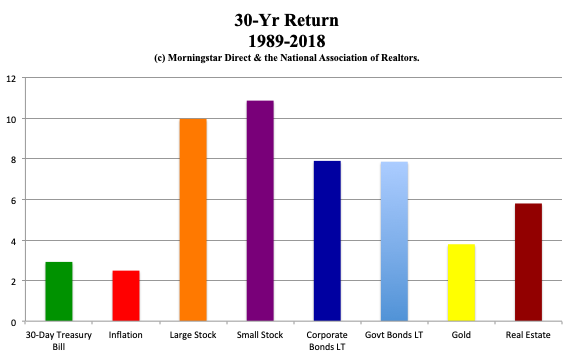

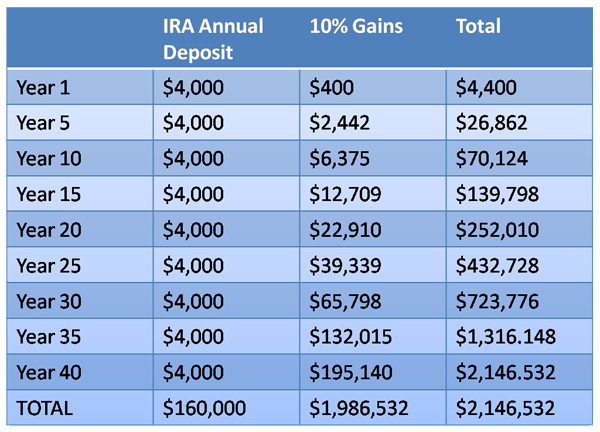

If you earn $100,000 a year and you put 10% of your gross salary in a 401K, IRA and/or health savings account, and that money earns 10% annually (what stocks and bonds have done over the last 30 years, on average), then you’ll have $50,000 in your nest egg within four years, over $100,000 in seven years and by year 25, your money will earn as much as you do in your annual salary, and you’ll be a millionaire.

Investing alone can make you a millionaire before you’re 50 (if you start at 25). It will offer your child half a million in her college fund within 18 years. Investing yields four times (or more) the money you gain if you were just saving it. (25 years of $10,000 annual deposits with zero interest is $250,000.)

Now, you might say, “I don’t earn $100,000 a year!” But the ratios work the same, even if you earn minimum wage. If you deposit 10% and that earns 10% returns, then your nest egg will equal your salary in just seven years, and by year 25, your nest egg will earn as much as you do. By comparison, if you are just saving, you only earn a fraction of that – missing out on all of the gains that compound year after year. If you’re not saving at all, you’re overspending and trapped in the vicious cycle of debt and debt consciousness.

If you’re investing in an account that is not tax-protected, then you’re also getting killed in capital gains taxes. (401Ks, IRAs, college funds and HSAs offer many protections, including savings on income and capital gains taxes).

Qualified retirement funds are also financial predator-proof. No matter who you owe money to, they can’t touch your retirement accounts. This is just one of the reasons why you must pay yourself first, even if you’re in debt. If you wait to pay off debt before you start investing in your own financial freedom, wealth and future, then you’re just making the debt collector rich at your own expense. You’re missing out on compounding gains. You’re suffering from debt consciousness. Your financial freedom depends upon you adopting wealth consciousness and providing for and protecting your own livelihood and future first. (Yes, you’ll still want to pay down debt. However, you’ll understand how increases your own assets and money while you sleep is one of the most effective tools to doing that.)

Over the last two decades, stocks have been pretty rough sailing – for Buy and Hope investors. The NASDAQ Composite Index lost 78% in the Dot Com Recession. The Dow Jones Industrial Average dropped 55% in the Great Recession. Buy and Hope has investors losing more than half every 8-10 years, then crawling back to even, only to see another plummet.

The financial indicators today are even more troubling than they were in 2000 or 2008. However, investors that diversified properly and used annual or quarterly rebalancing, earned gains during the last two recessions and have far outperformed the bull markets in between. That strategy is easy as a pie chart. You can read about this time-proven system in my books. You can learn and implement it firsthand by attending my Investor Educational Retreat. Check out Nilo Bolden’s testimonial by clicking on her name.

The most important first steps to take are to open the account, put 10% of your income on auto-deposit and to switch your thinking about money. Which is why I’m encouraging you to toss out the phrase “retirement plan” and select a sexier name for your personalized “Buy My Own Island Plan” or “Send My Kid to College Fund” or “Trip Around the World Dream.” Why? Because you’ll want to grow the gains of the fund that is working toward a goal. Whereas, odds are, you’re filing the “retirement plan” statements directly in some drawer without looking at them, hoping they’ll surprise you one day — pleasantly. That is, if you have even bothered to sign up for the 401k, Individual Retirement Account or Health Savings Account in the first place. If you want a pleasant surprise, you need a time-proven plan.

So, if you really want to go from paying bills to life’s a beach! get started now. Once you learn and implement a winning strategy, and commit to rebalancing it 1-3 times a year, you’ll be on the right track. Wisdom is the cure, and the time is now. Call 310-430-2397 to learn The ABCs of Money that we all should have received in high school.