A couple of recent mainstream articles really got me thinking about the early part of my career and money. Our struggles with debt show we were not very strategic when it came to thinking about our money, but what about careers.

I’m not sure if I ever had a calculated plan beyond heading to college and wanted to land a steady, well-paying job. I had no precise definition of what well-paying was, just enough to support my needs.

My parents had laid the groundwork for a good work ethic. My dad always worked. Over time, part-time jobs, and side jobs too over the years to bring in extra money, and my mom after raising five children returned to work once I the youngest was in school.

Even with no real strategic plan, other than working hard I’ve still managed to earn a six figure income. I’m not sure if that was a blessing or a curse given the mismanagement of that money for years. Would less of an income mean less failure or more, would a larger income mean we would have gone into even more debt?

I’m not here to second guess myself or speculate on what might have been. I’m all about moving forward these days. It does, however, make we wonder how to make these lessons valuable to my three children, and improve upon the things I was taught, and have them learn from my failures.

Critical Thinking

When I look at charts or read articles that cover topics on how much money you should be saving during certain periods of your life they make sense to me. I mean as a guy in his mid-forties, who over the least several years cleaned up his finances, they better.

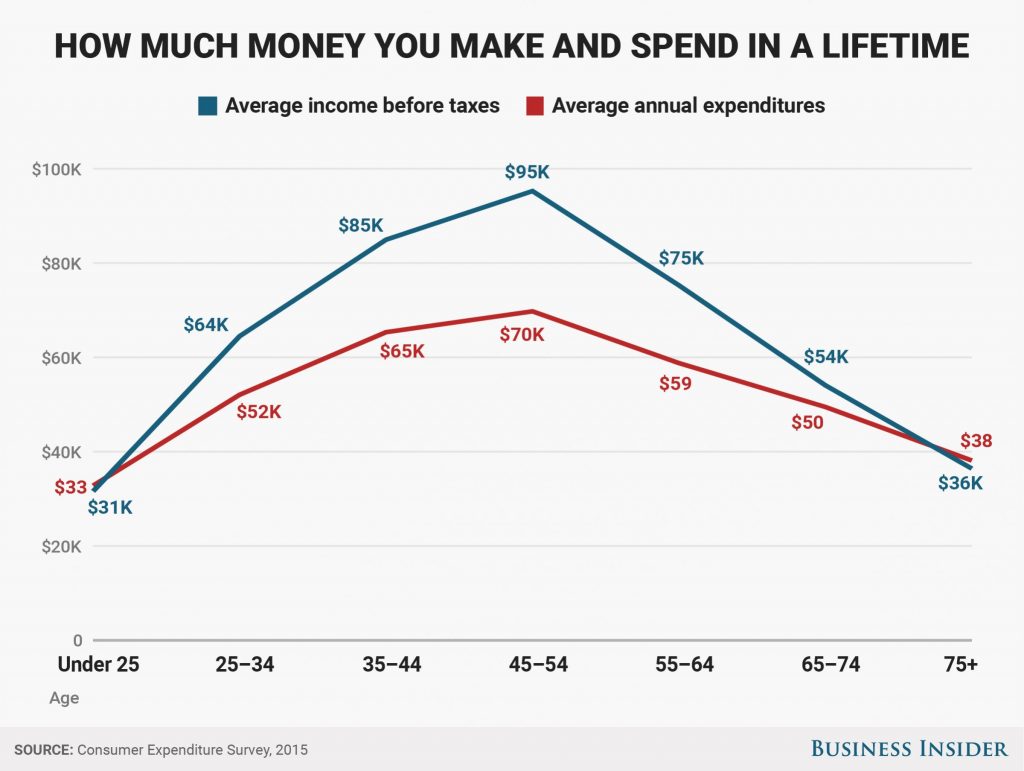

For example, this how much money you make and spend in a lifetime chart from a recent Business Insider article, compiled with data from a Consumer Expenditure Survey.

I get it your career and earnings have a trajectory, it’s not linear, and it should be upwards. I’m a little surprised at the decline in the early 50s. I would at least expect that to be flat unless you stop working altogether.

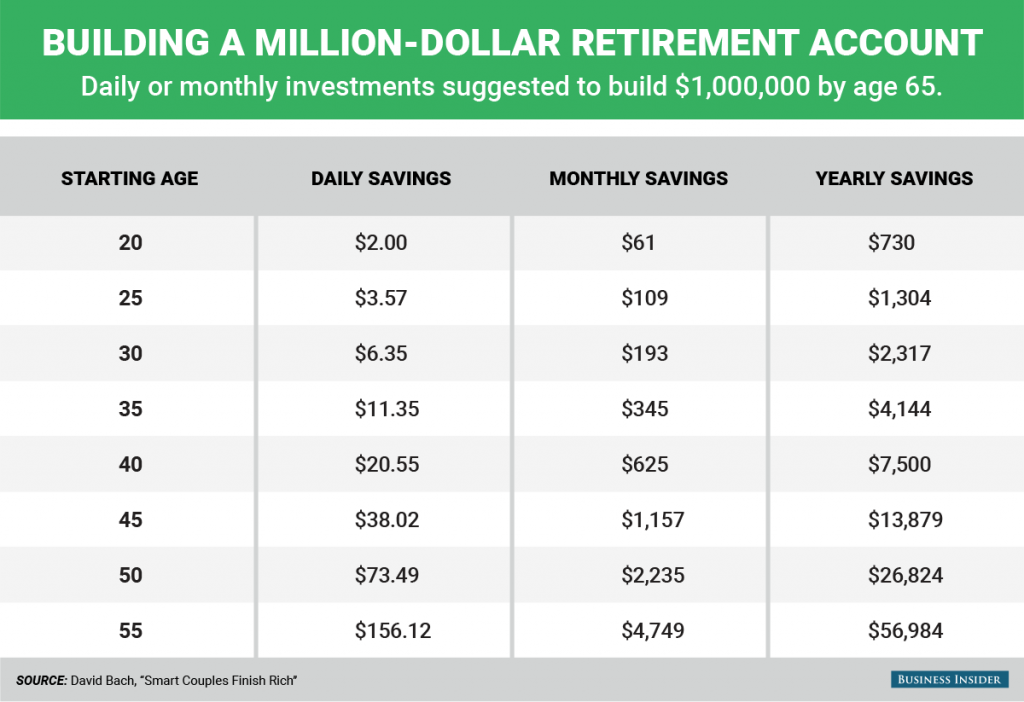

Looking at the above automatic millionaire savings chart, again pretty straight forward they earlier you start saving the easier it is to amass wealth, and the later, the more work you need to do.

Now how to bundle my years of experience, my money history, career knowledge into a meaningful way for my three children to look at the same information now, and get excited about it.

Well, honestly I’m not 100% sure, but I believe it starts with critical thinking. The ability to objectively analysis and evaluation of an issue or information in order to form a judgment.

If my kids can do that surely, they can see that saving money early and often will be good, no great for their futures. The key is getting them out of the routines they have been in for years.

Break The Cycle

Critical thinking is not the memorizing of facts that you can learn once and then use forever, such as the multiplication tables, its way of thinking about particular things at a particular time

Now more than ever, parents need to be strong partners with their school districts and vice verse. We both have something to offer.

For those parents lacking the tools to help their children in certain areas, the school system can offer assistance. Parents and the community as a whole can provide valuable real-world feedback and experience to help improve the quality of the education being taught.

This all require changes, breaking the regurgitation of facts and memorization of tables, and teaching better real world skills like:

- technology

- financial literacy

- interpersonal communication

- critical thinking

- teamwork

- career readiness

I’m really beginning to envy homeschoolers. Given a wider base of real-world skills students, our children will be less likely to follow in someone’s footsteps, because the will be able to make a path of their own. They will have the strategic ability to plot the course and critically think about the outcome.

Sure I just dump a ton of other stuff on our already overload children’s lives, but I’m pretty sure they can handle it. I believe it will relieve the mindless homework cry I have heard 100 times before in our household “when will I ever use this in my life.” The above skills will be carried for a lifetime, and take them much further than memorizing some textbook facts.

Have you ever been strategic about your career or money? What’s the best way to teach kids what you know now about careers and money?