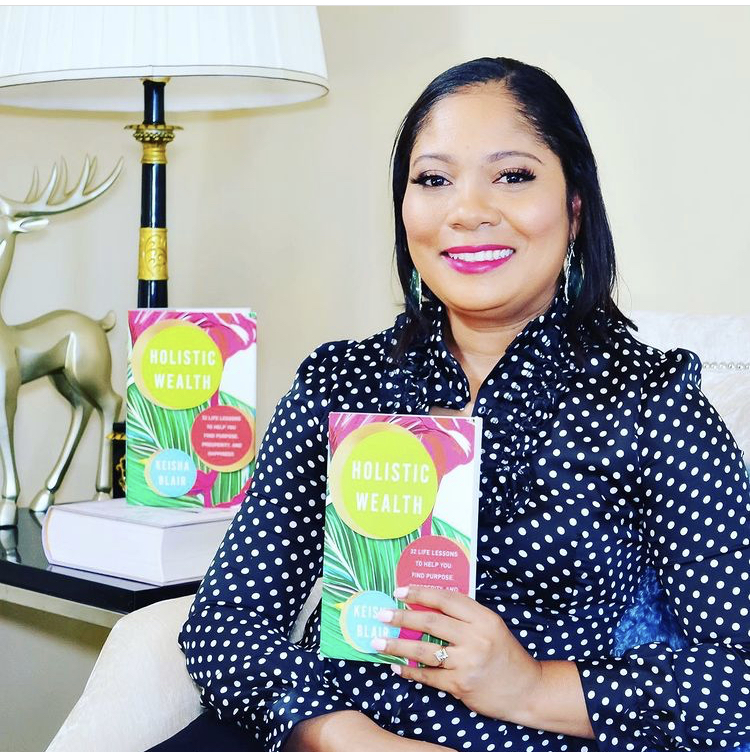

With many parts of the globe opening up, with COVID-19 restrictions loosening, millions around the globe are looking to shape their own destinies and chart a path forward. With the dominant themes during COVID-19, basically encompassing the key areas of Holistic Wealth, it’s a good time to take a look at the top 10 mistakes to avoid in achieving success. In my book Holistic Wealth: 32 Life Lessons To Help You Find Purpose, Prosperity and Success, I outlined a roadmap in order to reset for success after life-altering setbacks. This journey with my book Holistic Wealth started with my viral article entitled, “My Husband Died at Age 34. Here Are 40 Life Lessons I Learned From It.” The human response was universal: 50 million people globally viewed my article.

The messages shared in Holistic Wealth resonated with people from all walks of life, including Thrive Global founder Arianna Huffington and the producers of Jada Pinkett Smith’s web TV series, “Red Table Talk.” I know that we can overcome the chaos of adversity to reset for success after COVID-19, and thrive financially, physically, emotionally, spiritually and in relationship to others.

I’ve been training Certified Holistic Wealth™ Consultants at the Institute on Holistic Wealth, and I’ve gained even deeper insights on the toolbox needed to reset for success. Through lessons learned from top entrepreneurs, celebrities, and influencers (in my book) as well as on the Holistic Wealth Podcast with Keisha Blair, it’s clear that a combination of mental strength, grit and intentional lifestyle design are needed to reset for success.

Here are the top 10 mistakes to avoid in achieving holistic wealth and success:

1.Being Afraid Of Taking Measured Risks.

Measured risks are important to achieve certain goals. Assess the risks, consult with a professional and decide whether its worth it or not. Every risk is an opportunity to waiting to happen (if executed well). The Holistic Wealth Personal Workbook will teach you how to properly identify fake and real constraints.

On episode 10 of the Holistic Wealth podcast, I interviewed Helena and Feven Yohannes, Founders of 241 Cosmetics and their story has many unique lessons on taking measured risks. On the podcast, Feven and Helena describe how they didn’t even have a “boot to strap” in terms of bootstrapping their company. As political refugees who were born in a refugee camp in Sudan in the 1980s, and who immigrated to the U.S. via a green card lottery with sponsorship from Third Presbyterian Church in Rochester, New York, they knew how to stand in their strength.

As they told me on the podcast, “We were born in a tiny hut made of mud and grass – in the dark.” They buckled down and worked hard and, in December 2020, their company was featured on Oprah’s Favorite Things List 2020.

2.Hot Having A Personal Mission For Yourself

After COVID-19, you may want to switch jobs or switch careers or even start a business. Not crafting a personal mission for yourself is a mistake to avoid, or you will endlessly compare yourself to others, which will not only be a major distraction, it will make you miserable. The Institute on Holistic Wealth has a personal mission template that can get you started.

3. Copying Someone Else’s Personal Financial Identity

The next 24 months will be a crucial period in terms of resetting after COVID-19. It’s critical not to follow the crowd as society opens up and the spending starts to hit unprecedented levels. An article by Bloomberg, indicated that Americans have $1.7 Trillion to burn in revenge spending. Revenge spending can range from a luxury vacation, to buying a new car, house or on a clothing shopping spree. The key is not to get tempted to follow the crowd.

I developed the Personal Financial Identities Framework with a free quiz so that everyone can identify their personal financial identity and start harnessing its strengths. Stick to your budget and remember that emergency savings fund and keep it healthy.

4.Procrastination With Crafting Your Personal Networking Plan

In my book Holistic Wealth, I outlined strategies to craft your personal networking plan. This is a crucial part of resetting for success after COVID-19. Surround yourself with people who are successful in the path you want to take. The Institute on Holistic Wealth has a membership platform for networking and taking steps to empower you to achieve Holistic Wealth.

5.Ignoring Your Mental and Emotional Health

After COVID-19, we could all benefit from holistic healing. From our emotional and mental health as well as our physical health, COVID-19 has shown us that these are all inter-related and we need to take the time improve these areas of our lives in order to live holistically wealthier. It’s a mistake to ignore your emotional and mental health.

6.Underestimating the Value Of Accountability Partners

I’ve written before about the benefits of starting a Holistic Wealth Project Group. Participating in a holistic wealth project group can boost your happiness and joy and enable you to have accountability partners. Accountability partners can build momentum and enthusiasm for everyone’s goals and help each other to live according to their mission and to cultivate a Holistic Wealth Mindset™. A study by the American Society of Training and Development on accountability found that there is a 65% chance of completing a goal if you commit to someone. And if you have a specific accountability appointment with a person you’ve committed to, you will increase your chance of success by up to 95%.

The Ultimate goal with resetting for success should be developing your own unique Holistic Wealth Portfolio™. This is one of our core goals at the Institute on Holistic Wealth. We can help you design your Holistic Wealth Portfolio through one-on-one coaching and in addition, if you become a Certified Holistic Wealth™ Consultant, you can start empowering others to start designing their portfolios.

7. A Lack of Boundaries

Know when to say “no” to safeguard your time and energy. This is also critical in achieving your goals. Saying yes to everything and everyone will deplete you of your stores of holistic wealth so use your energy wisely. Budget your energy in the same way you budget your money.

8. Taking on Too Much Debt

Whether it’s student loans or other kinds of debt, paying off debt is always a good thing. Think creatively about how you can do this. There are very creative ways of tackling large expenses. As I stated in my book Holistic Wealth, being debt-free is an essential component of financial independence. Holistic Wealth is about creating the circumstances in your life that allow you to be resilient and resourceful. This will enable you to bounce back from unexpected challenges more swiftly and easily. To that end, paying off what you owe – is always a good thing.

9.Ignoring the Steps to Becoming Financially Resilient

Financial resilience is critical. Some of us will still live to be 100. The average person can expect to live nearly 30 years more than someone born in 1900 — almost to age 80 — and many people are living longer than that. Each person should do a careful assessment of their overall health, financial status, likely long-term care needs and family longevity. For that, it helps to have a Holistic Wealth Portfolio with strategies for financial resilience inbuilt. I discussed longevity planning in this article in the New York Times. I currently train Certified Holistic Wealth™ Consultants in developing financially resilient Holistic Wealth Portfolios™.

10. Not Embracing Gratitude and Mindfulness

Gratitude and Mindfulness are critical to achieving success and a holistically wealthy lifestyle. On episode 8 of the Holistic Wealth podcast, I interviewed iconic actress Kelly Rutherford, star of Gossip Girl, Melrose Place and so many other TV shows and films. Kelly shared her thoughts on overcoming life-altering setbacks — and regaining your power regardless of any situation by empowering yourself with a mindset shift and not playing blame and victim. The effects of toxic messages and other negative distractions in our lives can wreak havoc on our goals. Incorporating gratitude, mindfulness in your daily life and not overcomplicate things is also critical to success.