Have you ever wondered why there are so many brilliant people so far in debt? Financial literacy is something that most people are afraid to talk about and feel like they are helpless to learn about. There are people in the world who can go to college for over a decade to become a doctor who can’t seem to get a handle on their finances. Financial literacy is not a function of intelligence, though, it’s a function of being able to learn new things. This is where a growth mindset comes in – if you know you can learn new things you can conquer anything, including your financial situation.

What Is A Growth Mindset?

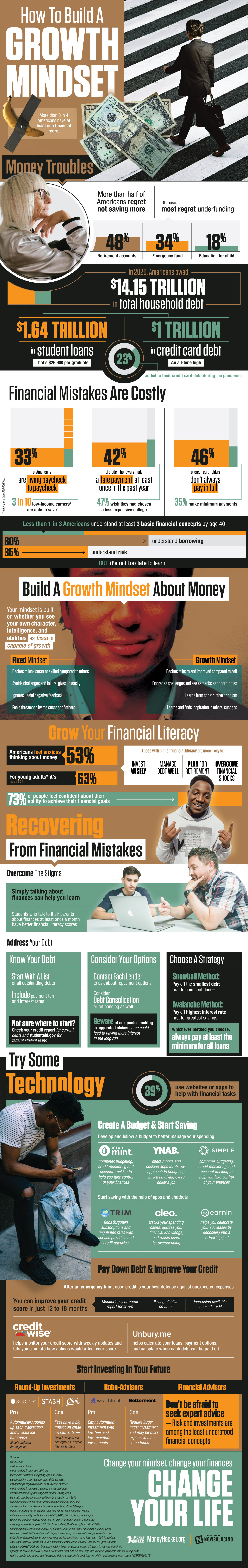

There are basically two types of mindsets – a fixed mindset and a growth mindset. A fixed mindset is where a person feels they already know everything or that they are incapable of learning new things – it’s the “you can’t teach an old dog new tricks” mindset.

On the other hand, a growth mindset is one where a person knows there is vast knowledge out there they can access if they go after it. They know they are capable of learning new things and achieving new heights. They are able to humble themselves and ask for help when they need it.

What’s more, people who have a growth mindset see challenges as opportunities to learn and see mistakes as teachable moments. They are inspired by the success of others and want to learn from other people’s successes and failures.

Financial Literacy Is Something That Can Be Learned

More than three quarters of Americans have at least one financial regret. Almost half regret not saving enough. People aren’t saving enough money for retirement, which is something that can have serious consequences later in life. If you think you are tired now, just wait until you are 80 and still working because you can’t afford not to.

Currently Americans are in debt and have close to zero emergency savings. Household debt has ballooned to $14.15 trillion, and credit card debt alone accounts for $1 trillion of that.

When you are ready to start learning how to deal with your finances, start by making a list of your monthly expenses and expenditures. Make a list of your debts, as well. Trim down everything you can on the expense and expenditure side, increase your income if you can, and put all your extra money toward paying off your smallest debt first while maintaining minimum payments on the larger debts. As soon as you pay off one small debt, shift all that money to the next and so on. Before long you will be debt free.

But just because you are debt free doesn’t mean you are finished yet. Next you have to start applying all that money to savings. Push forward as hard and as long as you can making incremental progress with your debt and savings and before long you will have something significant to show for your work.

Learn more about applying a growth mindset to your personal finances from the infographic below.