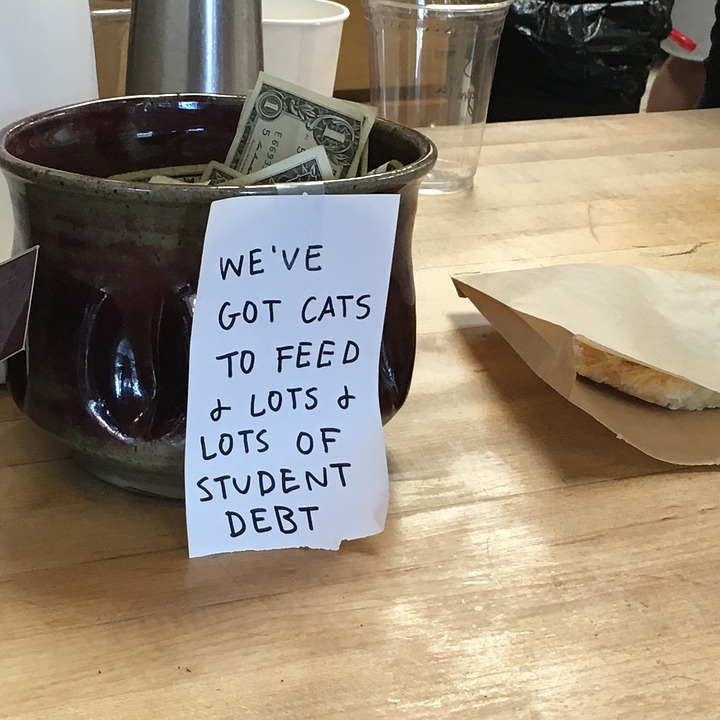

Too many talking heads now tell us that student loan was a waste, that those hard-earned bachelor’s degrees are nothing more than the 21st-century high school diploma… and with payments piling up we might be inclined to believe them.

How many of us are crippled by student debt? Nearly three-quarters of millennials with student loan debt told Bankrate they delayed a major life milestone – whether it be buying a home, saving for retirement or starting a family – because of their student loan debt.

Almost 45 million American student loan borrowers now collectively owe more than $1.5 trillion, and many have begun to wonder, “Was it worth it?” It’s a logical question, considering 11.4 percent of them are delinquent by more than 90 days, and 5.1 million borrowers are delinquent by at least a year.

Even though the majority of borrowers are making their payments, more than half of them struggle to meet those obligations, according to a 2018 study by OnePoll. With those struggles comes buyer’s remorse, as borrowers wonder if earning that degree was worth the financial hassle post-graduation

Regret Breeds More Regret

Regret consumes a lot of energy. Considered a higher-order emotion, regret involves both feeling and thought. The pair combine to activate a variety of secondary emotions, including frustration, disappointment, guilt and shame. These negative feelings can be harmful to your health.

“If you’re guilty, you’re probably getting stressed,” the Cleveland Clinic’s Dr. Michael McKee told WebMD. “If your body releases stress chemicals, it puts you at risk for minor stuff like headaches and backaches.

“It [guilt] also contributes to cardiovascular disease and gastrointestinal disorders. It can even have a negative impact on the immune system over time,” McKee said.

So, not only are you feeling bad about your student debt, but you might just feel yourself into a coronary.

Interestingly enough, feelings of regret actually can alter our memories as we imagine what might have been had we only taken a different path, says clinical psychologist Dr. Mary Lamia.

“According to cognitive scientists, the orbitofrontal cortex—a region in the frontal lobes in the brain—plays a fundamental role in mediating experiences of regret,” Lamia wrote. “The cognitive process, known as counterfactual thinking, has to do with our assessment of what was gained as compared to what would have been gained had we made a different decision.”

Therefore, because student debtors continue to face the same wage stagnation affecting all Americans and a wage reward ratio that’s remained level for at least a decade, they are more likely to perceive their college education as a bad decision and experience all the negative feelings associated with regret. But should they?

Buyer’s Remorse

Unfortunately, according to the OnePoll survey conducted in conjunction with EDvestinU, 80 percent of borrowers felt they had limited options when it came to taking the student loan – if they wanted to continue their education.

But with wages stagnant, many college graduates are buried in debt they can’t afford to repay, and two-thirds suffer from student loan regret. The group increases to 81 percent of those who owe more than $60,000 – all the while the annual cost of tuition, room and board at a public 4-year in-state school now exceeds $20,000. That’s a lot of negativity!

Is there any question why many now debate the value of a college degree?

College enrollment skyrocketed over the past 50 years. The 4.6 percent of Americans who completed a bachelor’s degree or higher in 1940 ballooned to 39 percent in 2018.

Since so many Americans graduated college, the workplace value of those diplomas decreased, in turn reducing the wage premium they commanded. After rapidly widening since the 1980s, the wage gap between workers with a college degree and those with a high school diploma slowed in the 90s before remaining relatively unchanged since 2010.

The “patterns indicate that the factors propelling earlier increases in the returns to higher education have dissipated,” the Federal Reserve Bank of San Francisco’s Robert G. Valletta wrote.

At the same time, more than 30 million U.S. jobs that do not require a four-year degree offer a median pay of $55,000 a year. You don’t need a post-secondary degree for a lucrative career as a real-estate broker, yet teachers often struggle to repay loans for their required credentials.

Add that to the fact that the price of college is increasing almost 8 times faster than wages, and it’s no wonder that trade school is an increasingly attractive alternative when it was once considered a less-desirable career path, reserved for those who “couldn’t cut it” at university. Not so in 2019! In fact, a growing number of post-high school study programs are pushing back against the 20th-century notion that the surest path to financial success was earning a college diploma.

A Look on the Bright Side

Student loan borrowers may feel like they are too often underemployed or forced to take a job outside of their degree fields, but at least they’re finding jobs.

Believe it or not, 95 percent of the 11.6 million jobs created from 2010-2017 went to bachelor’s degree holders. During that same American economic recovery period, only 80,000 new jobs were created for high-school graduates. Likewise, people without a college degree are three times as likely – 22 percent of the group – to be living in poverty.

While the wage gap isn’t widening much as of late, the college wage premium is still pretty substantial. According to the Federal Reserve Bank of New York, the average college graduate holding a bachelor’s degree earns about $78,000, compared to the average worker holding only a high school diploma, who earns around $45,000 a year – a premium of more than $30,000, or almost 75 percent.

Over a 30-year career, that cumulative wage gap becomes more impressive, easily exceeding $1 million. College-educated workers are also more likely to have employer-provided health insurance. That initial $50,000 investment doesn’t look so bad now, does it?

So, next time you’re writing out that check, try and look at the bright side and forget about the guilt.