Innovations in technology are constantly altering how we manage our finances. We can hire professional services to do the work for us, or we can empower ourselves and learn to manage them with new apps and technologies that help us control our finances and spending. The number of choices on the market is so great, some even equipped with artificial intelligence, that deciding which technologies to invest in can feel daunting. Here are ways to manage your finances in a tech-evolving world.

Managing Finances 101

Before diving into which apps are a good fit for your needs, you first need to map out your current financial situation and review the fundamentals of managing them.

First, examine your finances and determine your situation. Being honest with yourself and knowing where you stand can help you with a realistic plan to reach your goals. Compare your income and expenses and note areas you can trim costs for when creating a budget.

Next, set your financial goals. This crucial step will give you an idea of what you’re working toward. Define what you want to achieve and what expenses are appropriate to help you get there. This will help you create a feasible budget.

Once you know what path you’re on, create a budget and stick to it. Being strict with your spending can allow you to pay off debt, save for retirement, and add to an emergency fund. At this point, you can start looking at technology for assistance with financial management.

Organizing and Storing Important Documents

Qeepem

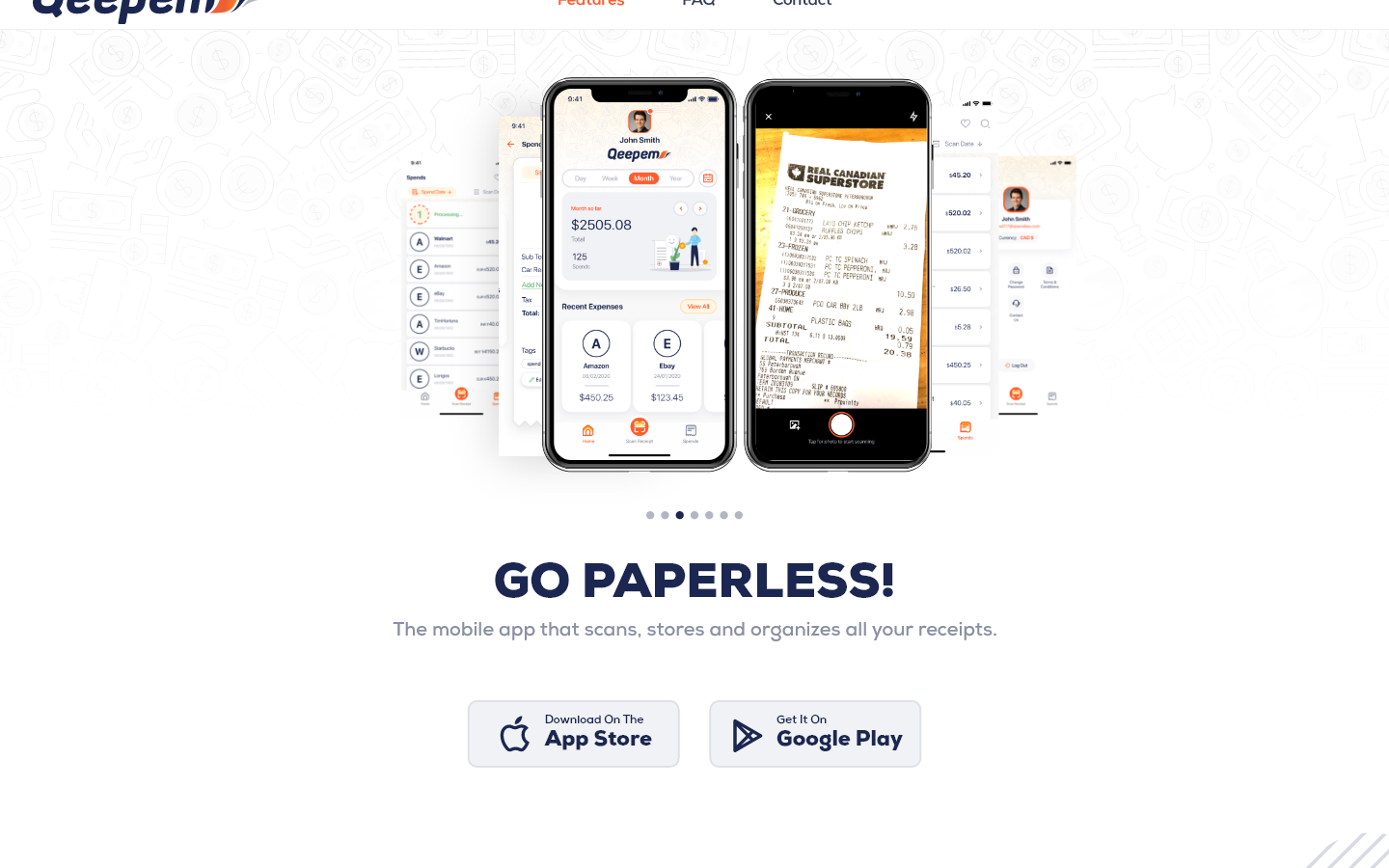

Keeping financial records and important documents is a critical part of financial management. It wasn’t long ago when boxes of physical copies of your receipts and invoices took up massive amounts of space in your office. Today, you can rely on the Qeepem receipt and expense tracker to house your essential financial documents.

The Qeepem app scans, stores, and manages documents like tax returns, invoices, and receipts, removing all of the hassles of managing paper documents that must be stored for 3-5+ years. Its goal is to be sustainable by eliminating physical receipt storage and making the entire process paperless.

Another unique perk of Qeepem is it uses artificial intelligence to analyze your spending patterns to offer customized recommendations based on what it has learned from your purchase history.

Budgeting Apps

There is a broad spectrum of comfort when it comes to being tech-savvy, and some users can feel intimidated. Most developers want their apps to be used by as many people as possible, so apps are created to be as user-friendly as possible. The market is heavy with budgeting apps, so it’s easy to pick one simple to use and with the features you want. Here are a few popular budgeting apps.

PocketGuard

PocketGuard is a free budgeting app that connects with all your bank accounts and integrates your recurring outgoing payments and income. Each day, it displays the daily amount you can spend using your budget plan, projecting your monthly income, and subtracting your upcoming bills. PocketGuard is also customizable, so you can create your own expense categories and set their limits. It will even let you export to a spreadsheet if you want to revisit some old habits.

Mint

Not only is Mint a budgeting app, but it also includes a free credit monitoring service. It focuses a lot on security, sending you alerts when large or suspicious transactions occur or when you’re close to going over budget. It also features reminders for upcoming payments so you can avoid overdrafts.

Honeydue

Honeydue is a unique app that condenses your family’s finances in one place for those who share accounts with a spouse or significant other. You can customize how much information you share with your partner, but it can display all bank accounts, credit card balances, loans, and investments at a glance. You can set up your monthly budget together, and the app will send alerts when there is activity.

Online Banking and Peer-to-Peer Payment Apps

Almost 65% of people use online banking in the United States. Convenience is a significant benefit, and when it comes to managing your finances, that’s what online banking allows. These apps enable you to check your account balances, transfer money, pay your bills, and even buy and sell investments. Some apps feature artificial intelligence to help you with investment decisions, quote insurance, calculate your net worth, and more.

Online banking integrates peer-to-peer (P2P) payment options like Zelle into their apps to make it easier to pay and request money between individuals. Venmo, PayPal, and Cashapp are other P2P options that allow payments to change hands immediately. You can monitor these transactions in real-time, similar to exchanging cash. Zelle deposits directly into your bank account, whereas the other apps store the funds in-app until you initiate the transfer process.

Shopping Apps and Mobile Wallet Technology

Shopping apps now have technology that helps you search for money-saving deals online and locally. They compare the prices of everything from groceries, apparel, services, and gas prices, while some apps even calculate the cost of driving to the store.

Smartphones feature a mobile wallet that allows people to link their credit cards and process payment at the point of sale in a store. Simply by holding your smartphone near the credit card reader and confirming with your thumbprint, the transaction will complete without you even touching the credit card or the reader.

What’s Next In Our Tech-Evolving World?

Technology is constantly developing, evolving, and improving. The world of finance will continue to benefit from these digital innovations and change how we manage our money forever. Innovators and entrepreneurs will keep developing new ways to manage finances in a tech-evolving world and simplifying our lives.