Your 5-Point Stress-Free Money Plan.

A conversation with Charles Schwab’s SVP and Chief Fixed Income Strategist Kathy A. Jones.

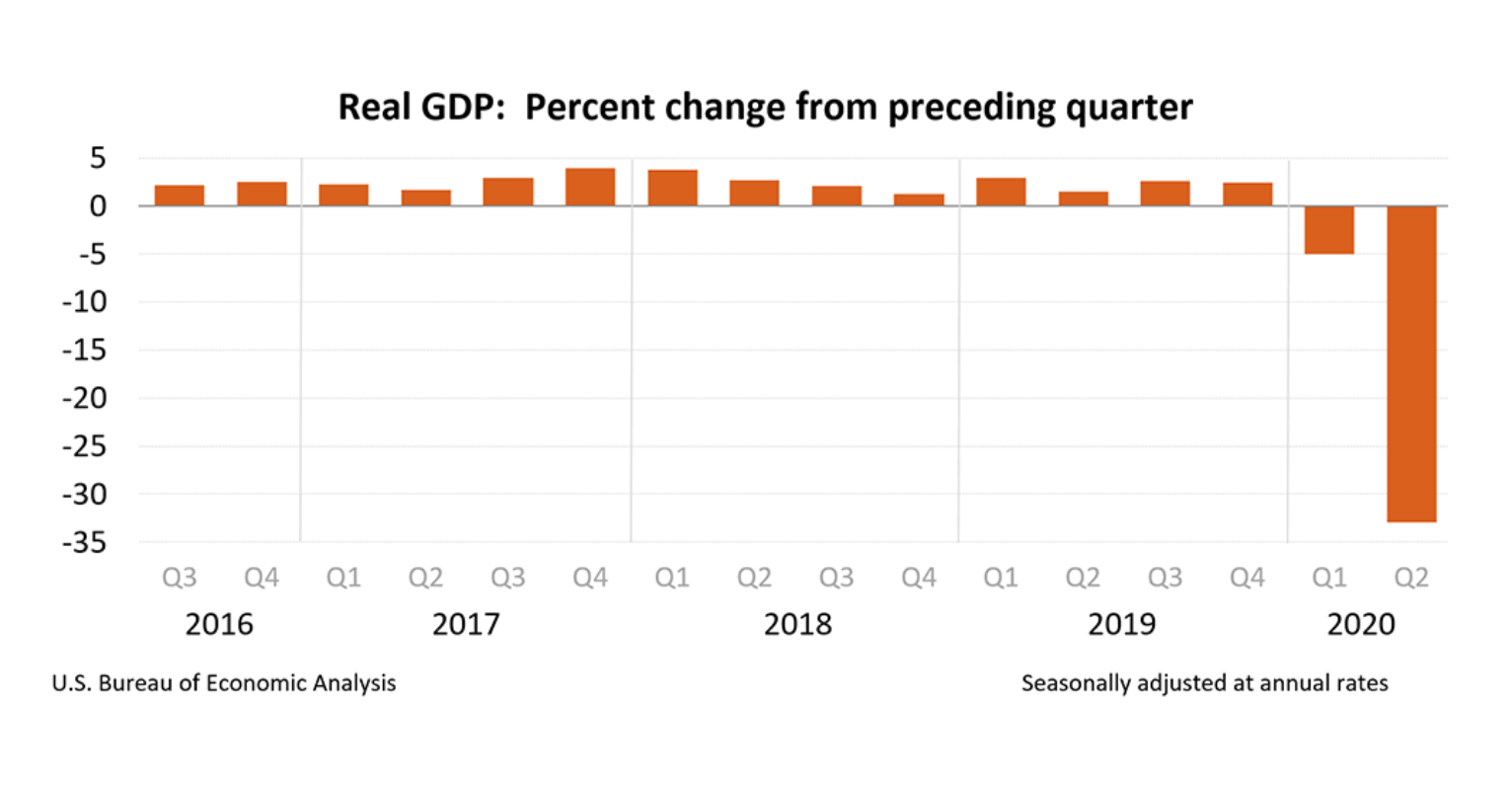

The S&P500 just hit a new record high. Investors have heaved a sigh of relief. However, memories of March and the 35% losses in the Dow Jones Industrial Average still haunt us. The White House boasts of job creation and the stock rally, downplaying the unfavorable data, like the 2Q 2020 GDP contraction of -32.9%, the 10.2% unemployment rate, financial leverage, high price/earnings ratios, junk bonds and the 28 million people who are claiming unemployment benefits. These statistics affect all of our lives.

Rather than hope and pray that the storm is over, now is a great time to build a solid financial house. Adopt a strategy that affords you the cash you might need in an emergency, and prevents your retirement from evanescing if stocks turn south. To assist you with your blueprint, I reached out to Kathy A. Jones for her inside perspective and wisdom. Kathy Jones is the Chief Fixed Income Strategist and SVP for Charles Schwab. In a candid and informative conversation, Kathy outlines key strategies each one of us can and should adopt now.

Your 5-Point Stress-Free Money Plan.

- Make sure that you have enough cash in your retirement plans and bank accounts, in case of losing a job or any other financial hardship.

- Review your investments to ensure they are properly diversified. Even the safe side has risk these days. So, you have to know what you own and why are you own it.

- Shorten the terms of your bonds and Treasury bills.

- Avoid industries that are overleveraged and vulnerable to the pandemic and recession. Make sure that any bonds or fixed income is creditworthy.

- Do not just have blind faith that somebody else is doing this for you. It’s your money and you have to be the boss.

Below is an excerpt of my conversation with Kathy Jones.You can watch the complete interview with Kathy A. Jones on my channel at YouTube.com/NataliePace.

Natalie Pace: 2Q 2020 saw the worst economic GDP contraction in recorded history (since at least 1974), at -32.9%. In February and March, the financial markets had frozen up. Even Treasury bills were illiquid. The Federal Reserve Board printed over $3 trillion to prevent a complete financial meltdown, and pushed the public debt up to $26.6 trillion in the bargain. What’s safe in that environment?

KAJ: U.S. treasuries are safe. If you hold them to maturity, you’ll get your principal back. I don’t think the U.S. government is going to default on that.

NP: The yield on Treasury bills is so low. Who wants to get locked into 1% yield or less, when that barely covers the expenses in many funds? Also, in March, even Treasury bills were illiquid.

KAJ:You could see depreciation in [treasuries] between the time you invest and the time they mature. One thing to do is to shorten the maturity or the duration. The longer the term, the more the risk of rates rising and seeing a price decline. With short term, you still have that safety and liquidity, but you’re not taking interest rate risk.

NP: Do you think there is a risk of downgrades in the municipal bond space? States and cities have been hit hard with pandemic-related expenses and a massive drop in tax income.

KAJ:We do think there is risk of downgrades. I’m worried about the state and local governments. They’re under a tremendous amount of stress from the pandemic. They’re losing tax revenue. They bear a lot of the brunt of the cost of this recovery, particularly with firefighters and hospitals. We suggest that investors focus on the higher-rated bonds, both in corporate and municipal bonds.

NP: Most people are not aware of the leverage in the corporate space. More than half of the S&P500 is rated at speculative (junk) or just one downgrade away from junk. Do investors have to look more closely at their corporate bond funds and holdings?

KAJ: In the corporate bond market, you want to stay in the A-rated space. Maybe a few BBBs, but you don’t want to get too committed to that space because if they get downgraded they end up in the junk bond space. When a bond gets downgraded, the price will gap down. There is a potential for the company to cascade into a default. Make sure there is not too much debt to repay, and that they are not a business that is really harmed by the pandemic, like tourism or retail. Industries that have been hurt by the pandemic are at risk of a downgrade.

NP: What happens in a downgrade?

KAJ: Things go down a lot faster than they go up. Know what you own. You want to understand what the dynamics and risks are. Liquidity can disappear really quickly. If you can’t sell your bond at a reasonable price in a reasonable amount of time if you need the money, that can put you in a bad place.

NP: There’s a Wall Street aphorism: “Never reach for yield.” How relevant is this today?

KAJ:I’m seeing suggestions that people should veer out of Treasuries and other safe, liquid assets and go into higher yielding assets. That’s not a terrible idea, except that most of those assets don’t have the liquidity that safe assets do. If you tie your money up in private equities or other alternative investments, you may have trouble getting that money out when you need it.

NP: The Federal Reserve Board has been purchasing bonds and even junk bond ETFs, leading those to trade back near the highs they were at in February, before the pandemic. Do investors need to be more cautious with these speculative issues?

KAJ: The market is acting like they are safer than they are. The Feds intended to make sure that the junk bond market had liquidity. It had frozen up. However, we can still see bankruptcies and defaults in there. Know what you own. Be careful. As long as the music keeps playing, people want to keep dancing. You don’t want to be the one left on the dance floor when the music stops.

NP: In a recent blog, you talked about how a weaker dollar might benefit emerging market bonds. Please talk a little about that.

KAJ: The dollar is poised to move a bit lower from here. That is typically good for emerging market bonds. They are quite volatile, and there are a lot of countries that are still feeling the pain of the pandemic. If you’re willing to take the risk in an emerging market ETF that is broadly diversified, they should be at a point in the cycle where they start to benefit. Argentina, Turkey and South Africa are places where you might not want to be involved. Typically, a diversified ETF or managed fund will give you exposure to a broad range of countries, so that you are not susceptible to a loss in one or two bonds.

NP: We’ve seen mutual fund redemption suspensions, mostly in European funds. Should investors be concerned that they will be locked out of access to their money?

KAJ:The fund can build in different provisions in their legal documents. It’s one thing to watch for. It’s a very uncomfortable feeling when you can’t get your money when you want to. Sometimes it’s not the worst thing. People panic and sell into an illiquid market. The gates can prevent that from happening.

NP: Is the U.S. at risk of a credit downgrade?

KAJ: We’ve been put on notice by a couple of the rating agencies. We are running these big deficits. It’s one thing to run a deficit in a recession. However, there doesn’t seem to be the political will to deal with that or make a plan. The rating agencies are telling us that if we don’t come up with a plan or show some concern, they’re going to downgrade us.

NP: It sounds like now is a good time to review your financial plan and make sure that you are safe, protected and properly diversified.

KAJ: These are difficult times for people. Sit down and look at your portfolio. Ask yourself, “What made me uncomfortable in March? Do I want to change my allocation so that I’m more comfortable? Do I really understand how much risk I am taking on?” Have some cash on hand, so that you are covered if you get laid off or have a problem that needs to get addressed. Now is a great time to do this. The markets are doing better. Things are calming down.